Purchasing a life insurance policy, particularly pure protection plans like term life insurance, will now be a longer process as life insurers are tightening underwriting provisions. Seeing a big surge in claims due to the second wave of Coronavirus, life insurance companies have made it mandatory for potential policy buyers to answer COVID questionnaires and have a post-COVID cooling period ranging up to three months.

Besides, they are insisting on medical tests for those who have tested Covid positive before the purchase of term life insurance policies.

This comes as insurers are under pressure by reinsurers who take a majority of risk on their books. The rising claims have also impacted the profitability of life insurance companies with several insurers making a provision in their books for the deluge of Covid insurance payouts following the second wave.

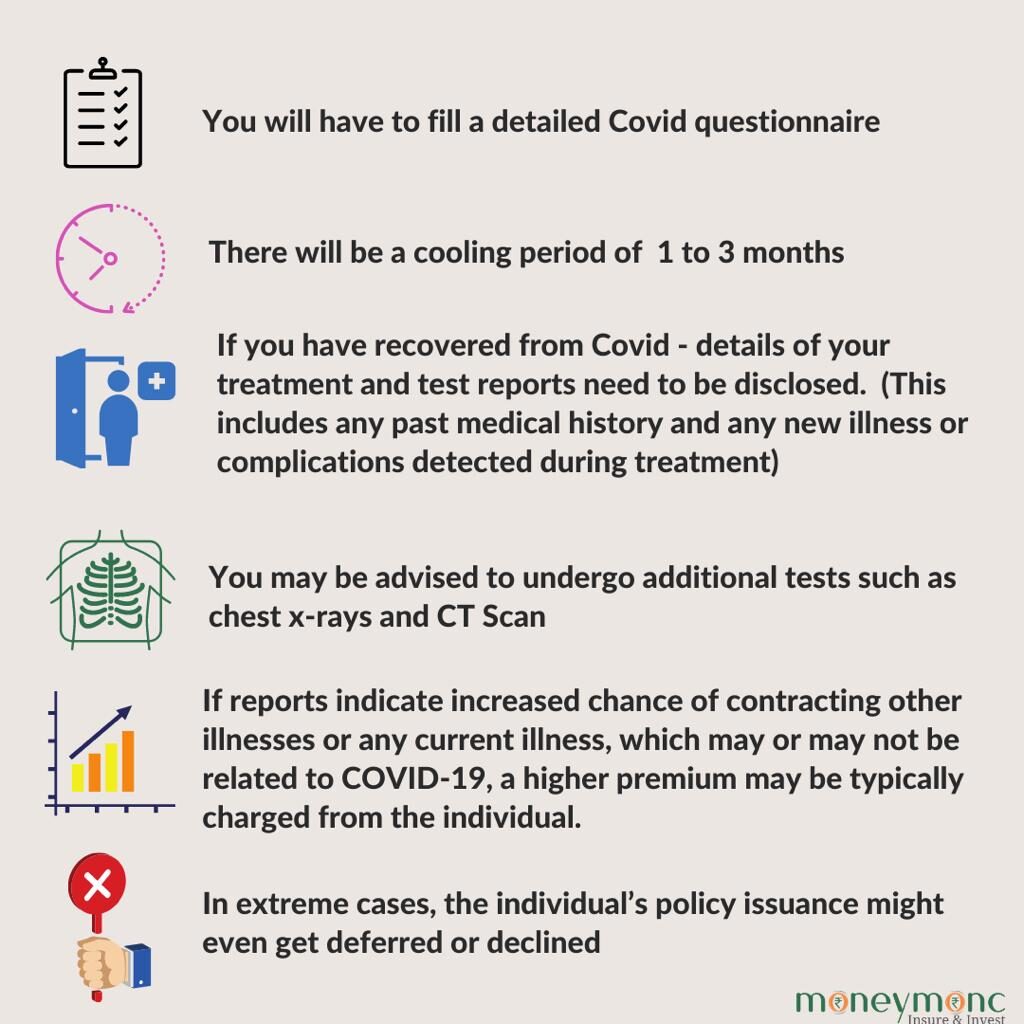

Detailed Covid questionnaire

Anand Pejawar, President – Operations, IT and International Business, SBI Life Insurance said, “Ever since the outbreak of the pandemic, a Covid questionnaire is required to be filled by all individuals while applying for the fresh policy. This has been made mandatory by all insurers. This is also a part of the reinsurance requirements.

But what exactly does the Covid questionnaire contain? If a person has recently recovered from Novel Coronavirus or Covid19, she is required to disclose information in this regard.

The proposer may be requested by the insurer to disclose the date of detection of infection, the date on which the person recovered from infection etc.

“Further, the proposer may be required to provide details of treatment taken during the infection, any past medical history and any new illness or complications detected during treatment and after recovery from the infection,” says Sunil Sharma, Chief Actuary and Chief Risk Officer, Kotak Mahindra Life Insurance.

Apart from the Covid questionnaire, the individual will also have to submit all the relevant test reports to buy life insurance policy, says Manoj Jain, MD, Shriram Life Insurance.

Cooling period of three months

The cooling off period will depend upon the severity of the illness the person has had. It differs on a case to case basis. If the COVID survivor tests negative, the cooling period ranges from one month to three months from the day of the negative test. This is being done for a secure purchase of life insurance policy as it eliminates the risk to life, said Naval Goel, Founder & CEO, Policyx.com.

For example, for mild cases or asymptomatic cases, which did not require hospitalization, there will be a cooling off period of a month.

But if the individual had a more severe illness which required hospitalization, either regular or ICU, the cooling off period will typically be longer, say about three months.

Incidentally, the other possibility in the responses to the questionnaire would be that the individual may not have had COVID-19 themselves but may have been exposed to certain other external factors (such as family member testing COVID-19 positive or the individual having recently travelled to a country which is grappling with the pandemic). This would increase their chance of contracting the disease.

“In such a situation, a cooling off period of 14 days will typically apply before the person is considered eligible for purchasing the life insurance policy,” said Akshay Dhand, Appointed Actuary, Canara HSBC Oriental Bank of Commerce Life Insurance.

Additional disclosures

According to Dhand , “Once the cooling off period is over, the individual will not only be subject to the typical underwriting, which he or she would have had to undergo anyways for buying life insurance, but will also be required to undergo certain specific medical tests such as chest X-Ray etc.

In addition they will have to provide full details of their medical records related to COVID-19 treatment. The output of these tests and the scrutiny of the medical records will decide the kind of coverage which can be offered to the individual and any additional charges or premiums that he or she will have to pay for the same.”

If the reports indicate increased chance of contracting other illnesses or any current illness, which may or may not be related to COVID-19, a higher premium may be typically charged from the individual.

In extreme cases, the individual’s policy issuance might even get deferred or declined, added Dhand.

Goel of Policyx.com says the disclosures may vary from company to company as life insurance companies are getting stricter with their underwritings to evade the increasing number of risks. The general disclosures include proposal form, including pre-existing medical conditions.

As per medical guidelines, diabetes, lung diseases and other chronic lifestyle disease are considered more critical at the moment as COVID 19 is likely to leave prolonged diseases due to steroids taken during the treatment.

According to reports, the life insurance industry has paid around Rs 2000 crore in claims in FY20.

On Covid claims, Pejawar from SBI Life said as per the IRDAI guidelines, all Covid claims are paid, unless proved to be fraudulent. After three years, there is no question of repudiation of claims, even on non-disclosures, he said.