Processing of your vehicle accident claims has become faster than ever before as insurers are now offering customers the option to settle claims through their self-service mobile apps.

While the COVID19 pandemic has forced most companies to adopt the technology route, general insurers have seen a huge acceleration in the digital processing of motor insurance claims with the help of tools like artificial intelligence (AI) and big data.

The digitized process ensures that in case of an accident or a vehicle mishap, you can lodge the claim immediately using your insurer’s mobile app, which will use data and AI to analyse the images and the video and send you an estimate of what they will be willing to pay.

Once you accept it, the claim amount will be transferred to your bank account.

Each step in the claim settlement process has been digitized involving minimal to zero paperwork and eliminating the need for a physical survey, which has helped reduce the claim settlement time from days to hours. As agents and surveyors found it difficult to travel due to lockdowns and social distancing, a digitized automated process was the easiest way to process claims instantly.

Built-in elements

ICICI Lombard, in fact, crossed 1 million motor insurance claim approvals through the Instaspect feature on its app which has built-in interactive elements like an instant survey on live video call assisted by claims manager and query resolution in real time. They have significantly contributed to the app’s popularity.

Roopam Asthana, MD of Liberty Insurance, in a recent interaction with Moneymonc said the company uses digital assets for assessment of around 50 percent of the claims.

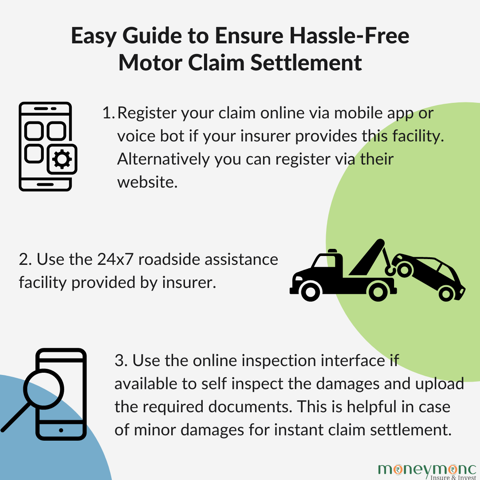

Here’s what you need to know to ensure a seamless digital motor claim settlement experience without stepping out of your home amid COVID19.

Step 1 – Claim Registration

You can register your motor insurance claim online via the insurer’s website or through their mobile application. Apart from providing details of the incident, one can click and upload pictures, videos of the damaged vehicle and documents related to the incident effortlessly.

While registration via the call centre or email continues, companies now have also launched voice bot services, allowing its policyholders to register their motor insurance claims easily.

For instance, ICICI Lombard has launched a voice bot for claim registration. To avail this service, one needs to call ICICI Lombard’s helpline and select the relevant option to get connected to the voice bot. The bot guides the customer in claim intimation through a web-based link which is sent via SMS.

After receiving the SMS, the customer needs to provide the incident details in the link provided, post which the bot registers the claim and shares the claim number instantly. In the coming days, the bot will be enabled to facilitate customers to upload claim documents and submit an e-form. The conversational interface reduces the chances of error while typing or navigating.

Step 2 – Claim Investigation

Majority of insurers today have automated their pre-inspection process that traditionally involved manual intervention. This has proved to be extremely beneficial given the lockdown and restrictions in movement. The process involves either a video call with the insurance company surveyor or a guided smartphone enabled process that enables customers to inspect their vehicle on their own without having to wait for a third party. So we recommend you check this facility with the insurer rather than going for a physical assessment.

Insurers are trying to create an ecosystem that ensures all their stakeholders are digitally equipped to ensure faster and transparent solutions.

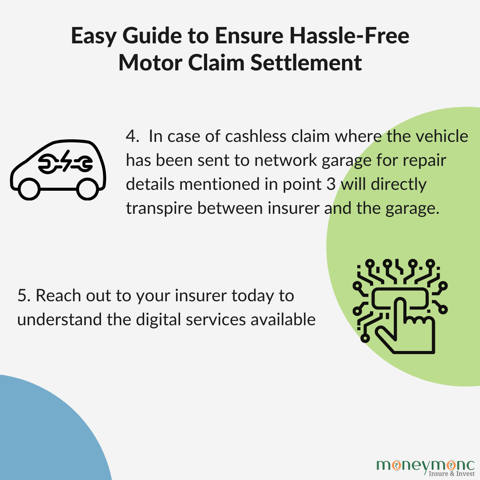

Insurance companies have also equipped their network garages with requisite tech infra which includes API Integration that allows their partners to share information real time and fasten the process.

Vishal Shah, Head of Data Sciences at Digit Insurance says, “Our claims management process is 100 percent digitized. We not only provide an audio claim registration facility but policyholders can also inspect any damages through the self-inspection app using their mobile phones.”

“This has cut down inspection time to just 10 minutes,” Shah adds.

Step 3 – Evaluation of Damages

Use of AI, image analytics and big data has enabled faster and precise claim evaluation with minimal human intervention. It helps gauge the damage suffered by the vehicle instantly. The assessment often happens in real time when the customer or the network garage uploads the damaged vehicle’s pictures and details on the shared interface. The data analytics tool embedded in the systems compares the images and data shared with past data repository to draw a comparison and calculate the compensation.

“About 87 percent of our motor claims are approved within 24 hours. Tech-enabled solutions have empowered both customers and the insurer,” Shah says.

For the customer it brings faster and relevant solutions with reduced waiting period minus the hassle of documentation. For the insurer it brings in operational efficiencies, he adds.

Step 4 – Claim Settlement

As soon as the damages are evaluated the policyholder receives the claim settlement details along with the amount receivable via SMS or email. If the individual is satisfied with the assessed amount, the claim amount is transferred immediately to the customer’s account. The approval is sent to the network garage to start repairs in case of cashless claims.

For instance, Bajaj Allianz’s ‘Motor on the Spot’ initiative has reduced the end-to-end claim settlement period to 20 minutes for minor claims (worth Rs 30,000 for private cars and Rs 10 000 for two-wheelers). This initiative allows the customer to self-inspect the vehicle damage and file a claim through the company’s self-service mobile app – ‘Caringly Yours’. Customer just needs to click pictures of the damaged vehicle, enter policy number and relevant bank details. If all the details are in place and the customer agrees to the assessed amount, the company transfers the amount within minutes.

Eliminating frauds

For the calculation of liability amount the system requires images of damaged parts in specific angles. Motor OTS feature under Bajaj Allianz’s ‘Caringly Yours’ app provides the directions in which the customers should click images of damaged parts within the application.

One can’t upload the images already clicked in the app.

“Through data analytics tools embedded in Motor OTS, we are able to compare the images clicked by the customer with our existing data repository. This helps us to determine the eligible claim amount and also identify fraudulent claims if any,” said TA Ramalingam, Chief Technical Officer, Bajaj Allianz General Insurance.

Digit Insurance also uses image analytics, AI, ML to tackle fraud management and has created a fraud management engine to trap the fraud cases. “We also personally do checks, background verifications, profiling of claimants and are on the lookout for other means that can help us filter out fraud cases,” said Shah.

He said tech-enabled solutions not only make things easier for customers, they help insurers by improving operational efficiencies by reducing repetitive work through bots, increasing productivity and keeping a lean system resulting in higher premium to employee ratio.

(Chandni Arora is a Jodhpur-based writer, who writes on Insurance, culture and lifestyle.)

I am heartily impressed by your blog and learn more from your article. Thank you so much for sharing with us. I find another blog as like it. If you want to look visit here Motor Vehicle Accident Claim in Alberta . It’s also more informative.