Handling crisis and risk is at the core of insurance business. With the COVID-19 pandemic, insurance companies found themselves in the centre of a storm. In a matter of hours and days they had to make their entire operations remote. At the same time, the insurance regulator IRDAI clarified that Covid is covered under all existing insurance coverages and asked general insurers to launch Covid-specific policies like Corona Kavach and Corona Rakshak.

Amid all this, companies found themselves struggling with a surge in insurance frauds. These frauds are typically committed at the time of applications or claims, and cost a whopping ₹45,000 crore every year to insurance companies. Nearly 70% of these frauds are committed via falsification of documents. As per industry estimates, insurers lose close to 10 to 20 per cent of their overall premium collection to frauds.

Modus Operandi

In an earlier interaction with Moneymonc, Shanai Ghosh, ED Executive director and CEO of Edelweiss General Insurance said that the industry saw frauds with respect to Covid-specific products, especially Corona Rakshak. Corona Rakshak is a benefit policy that provides 100 per cent lumpsum payout of the sum insured if the policyholder is hospitalized for over 72 hours due to COVID-19.

For instance, fraudsters would purchase policy for a premium as low as Rs 2000 and claim Rs 2.5 lakh by staying in the hospital for three days.

Ghosh said they have identified the signals of fraud and help put in processes, conduct investigation, and are able to prove a lot of frauds in both Corona Kavach and Corona Rakshak.

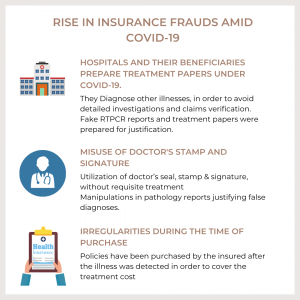

According to TA Ramalingam, Chief Technical Officer, Bajaj Allianz General, the hospitals and the beneficiaries prepare treatment papers under Covid-19 diagnosis in place of other illness in order to avoid detailed investigations and claims verification.

Their investigation has found that even fake RTPCR reports and treatment papers were prepared with the doctor’s seal & stamp and signature to claim insurance.

This was done by manipulating pathology reports and justifying false diagnoses. In many cases, insurance was purchased after the illness was detected in order to cover the treatment cost.

Dr S Prakash, MD, Star Health insurance said even during the crisis when it is time to show solidarity and empathy, the industry saw a tremendous increase in the number of fraudulent claims from various sources in the distribution chain – sometimes from intermediaries, or from hospitals and even from customers.

In the past few months Star Health has blacklisted around 100 hospitals from where the fraud cases are rampant.

Out of the large number of claims received by Bajaj Allianz General Insurance, it investigated a handful of them. About 30 per cent reported adverse findings.

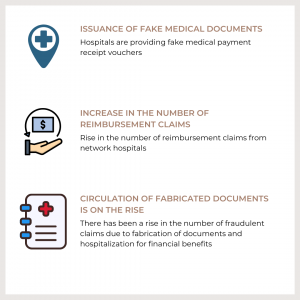

Some fraudulent trends that they have observed over the last 3 years include, hospitals providing fake medical payment receipt vouchers. There has been a rise in the number of reimbursement claims from network hospitals besides fabrication of documents and hospitalization for financial benefits.

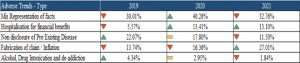

Following are the major adverse trends observed in the last three years: (Out of total identified cases with adverse findings.

Source : Bajaj Allianz General Insurance

Insurance frauds are not restricted to any specific region as they are mainly caused due to process gaps or control lapse which gives fraudsters an opportunity to commit a fraudulent activity.

However, Maharashtra, Gujarat, Uttar Pradesh, West Bengal are some of the regions where insurance frauds are rampant, said Ramalingam from Bajaj Allianz.

“The pandemic has since last year provided a fertile ground for an increase in the incidence of insurance frauds while restraining insurance professionals from doing their jobs safely,” said Shivindra Pratap Singh, managing director, Lancer Network Limited.

Digitisation of Fraud Investigation

Singh from Lancer network added that while the pandemic lingers on, this is an ideal moment for the fraud & risk mitigation fraternity of the Indian Insurance Industry to prepare for the future by developing their skills and embracing a more inclusive ‘new normal’.

In an earlier interview with Moneymonc, Roopam Asthana said that the insurance industry witnesses substantial frauds that unfortunately take place on a regular basis and the industry must manage them.

“There are various estimates but about 8 to 15 per cent of all claims are fraudulent. So if the industry is able to cut that down to half, the benefit can be passed on and that’s where insurance companies are putting a lot more effort.”

He added that they are leveraging technology to tackle fraud. The insurer has introduced OCR technology that captures all the information that comes on a bill which is passed through an artificial intelligence-based system which identifies the various components and compares it across different categories. It is then able to highlight certain claims as fraudulent.

According to a report released on July 23, titled Impact of Covid-19 Pandemic on Insurance Fraud Risk Mitigation and Investigation, insurers have increasingly digitised its fraud investigations in the wake of Covid-19.

Deepak Godbole, secretary-general, Insurance Institute of India said, “Insurance frauds in the form of inflated or false claims hurt not only the insurance companies but also their customers or insurance buyers, who have to pay higher premiums as a result.”

Godbole added that the growing adoption of technologies like artificial intelligence and data analytics are enabling better and faster insurance investigations, which augurs well for the industry.

Bajaj Allianz introduced a special Investigation and Loss Mitigation department in August 2013. The objective behind the formation of the department was to ascertain the fact finding on the loss report or cases referred through Whistle Blow Policy, which will minimize the company liability through extensive investigation. This department takes care of motor investigations, non-motor investigations, health investigations, vigilance and deterrence. The team comprises insurance experts, lawyers, Engineers, Doctors, Chartered Accountants, Forensic Science Expert, Data Scientists and also consultants who have previously served as police officers. “The training needed for this domain is quite vast and advanced investigation skill and technology is needed. We regularly conduct training and knowledge sharing sessions to up-skill the team members so that they can achieve effective performance in an activity or range of activities required,” added Ramalingam from Bajaj Allianz.

The rise of frauds post-Covid is a concern for the insurance industry as fraudsters inevitably work to exploit emerging system gaps. This also leads to continued rise in cost of insurance for honest consumers. Particularly, in health insurance, where insurers have raised prices due to facing higher claims during Covid and general medical inflation. Insurers need to act swiftly and decisively with specific counteractions to frauds and ensure that honest customers are not paying for inflated claims due to fraud.

(Deepa Nair is a Mumbai-based journalist specialising in finance and international affairs.)