As much as COVID19 pushed digitisation of services to the forefront, its effect on corporates hiring gig workers, freelancers has been similar. People no longer question the efficacy of remote working and this extended flexibility has led to the formation of a sizeable gig workforce for the country.

According to ASSOCHAM, India’s gig economy is expected to grow to $455 billion by 2024 at a compounded annual growth rate of 17%, with the potential to grow at least double the pre-estimates for the post-Covid-19 period.

By 2025 India is likely to have 315 million gig worker jobs.

The perks of insurance, PFs etc are not extended to gig workers. Coupled with the absence of a regular income, safeguarding themselves from financial emergencies should be the top priority for freelancers.

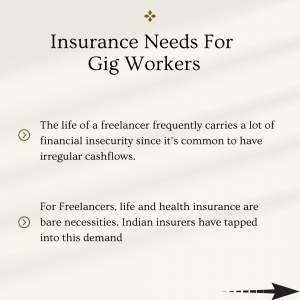

According to Peuli Das, Chief and appointed actuary, IndiaFirst Life, “The life of a gig worker or a freelancer frequently carries some additional challenges. There is financial insecurity since it’s common to have irregular cash flows.”

Depending on the job, health and life risks might be pronounced as they may be working in makeshift arrangements or having to go through frequent travels and rush-hour commute or land up in remote places where work conditions are inferior to what traditional employees are exposed to.

“So for gig workers, life and health insurance are bare necessities,” says Das.

Take the example of production houses that employ gig-workers on a project to project basis. As per Vivek Chaturvedi, CMO at Digit Insurance, “Production houses engaging transient workgroups do seek insurance covers for the crew members. But once the project is over, the cover ends and is applied to the new staff members that come on board.”

While there is a wide health and life insurance gap in the gig economy, most gigsters are not motivated much by these non-monetary benefits. As per a BCG report on the subject, while appreciated, non-monetary benefits (insurance, working capital loans, etc.) are not high on the priority list for low-income workers, who are willing to trade around 1 to 2% of their income for it. A lack of financial literacy of insurance as an investment is the biggest bottleneck here.

“Most gigsters fail to understand that while health insurance provides a safety net in case of a workplace injury or health hazards leading to diseases and costly medical treatments, life insurance at its core ensures protection against the financial burden that death can inflict on the family,” adds Das from Indiafirst Life.

Calculating the appropriate health and life insurance cover

“It is time that freelancers realise the importance of having an adequate health insurance policy,” says Chaturvedi from Digit.

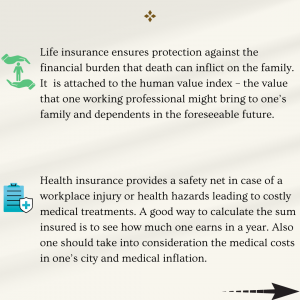

“A good way to calculate the apt amount of medical insurance coverage is by evaluating how much one earns in a year. Also, one should take into consideration the medical costs in one’s city and medical inflation,” he says.

A higher sum insured, started early on in life, makes more sense because as one gets older, that same sum insured will cost more.

And if a health condition develops then sometimes the higher value is more difficult to get as well, he adds.

Along with a health insurance cover, the ideal life insurance policy coverage must also be arrived at. As per Peuli Das, “Life insurance is attached to the human value index – an ideal limit can be arrived at by considering the financial value of the life of a freelancer – the value that one might bring to one’s family and dependents in the foreseeable future.”

Estimating the ideal limit also requires careful consideration of all anticipated expenses such as failing health of ageing parents, tuition fees of children, paying off a mortgage or increasing medical costs, etc.

Insurers offer Human Life value calculators that provide reasonable estimates along with offering affordable health insurance and daily hospital cash benefit and associated income replacements.

Naval Goel, Founder & CEO, PolicyX.com says that while individual health and term life insurance plans are crucial for each individual. But when it comes to freelancers, they must plan their insurance portfolio securing various other risk scenarios with the following covers:

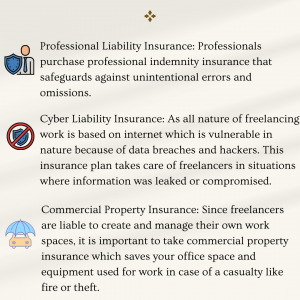

Professional Liability Insurance: It saves the freelancers from getting sued by clients who claim that your product whether in the form of writing or any product created was negligent due to any error. This policy bears all expenses of the legal process, for freelancers who are found innocent.

Cyber Liability Insurance: As all nature of freelancing work is based on internet which is vulnerable in nature because of data breaches and hackers, this insurance plan takes care of freelancers in situations where information was leaked or compromised.

Commercial Property Insurance: Since freelancers are liable to create and manage their own work spaces, it is important to take commercial property insurance which saves your office space and equipment used for work in case of a casualty like fire or theft.

Commercial auto insurance is again an important nature of insurance that freelancers who are into travel blogging and usually travel for work for client meetings so safeguard themselves in case of an accident.

The emergence of successful gig work platforms further point to the necessity of getting gigsters covered under adequate insurance policies to ensure their financial stability. By establishing insurance as a social security tool for freelancers, India will be fully prepared to unlock the sector’s possibility in the times to come.

(Elizabeth is a Qatar based writer and content consultant who loves to explore topics that spark her curiosity and challenge her existing notions of life and its experiences.)