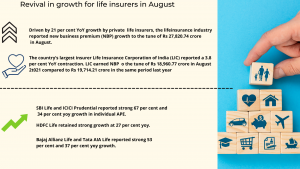

Life insurance industry reported new business premium (NBP) growth to the tune of Rs 27,820.74 crore in August, driven by 21 percent year-on-year growth by private life insurers even as LIC reported a decline.

The country’s largest insurer, Life Insurance Corporation of India (LIC), reported a 3.8 percent y-o-y contraction. LIC earned NBP to the tune of Rs 18,960.77 crore in August 2021 compared to Rs 19,714.21 crore in the same period last year.

“The life insurance industry has bounced back strongly in August. This growth has been largely fuelled by PSU-led bancassurers, most of whom are growing at over 45 percent year on year,” said RM Vishakha, MD & CEO, IndiaFirst Life Insurance.

IndiaFirst Life, at 84 percent growth over FY 21, is the fastest growing company among the top 10 private insurers, she pointed out.

IPO-bound LIC reported a decline of 5.1 percent Y-o-y in individual weighted received premium (WRP).

In contrast, private sector players’ saw WRP growing 39.1 percent Y-o-y in August (two-year CAGR of 14.5 percent), while the industry posted a growth of 18.9 percent. In FY22 YTD, private players’ Individual WRP grew 30.8 percent Y-o-y .

Subhendu Kumar Bal, Chief Actuary & CRO, SBI Life Insurance and President, Institute of Actuaries of India, said, “The current pandemic has led to an increased awareness of the insurance business, more specifically the protection business.”

“An increase in the share of their protection business in the portfolio would lead to healthier bottomline for insurance companies. The rising awareness would lead to higher insurancepenetration and would be good for the insurance industry in the near future, Bal from SBI Life added.

Private insurers garnered Rs 8,859.97 crore in NBP in August, up from Rs 7,325.58 crore in the year-ago period.

On the other hand, LIC earned NBP to the tune of Rs 18,960.77 crore in August from Rs 19,714.21 crore a year ago.

“The overall resurgence in the Indian economy is manifesting in the insurance sector as well. The August 2021 NBP number specially for the private sector companies is backed by positive trend across the industry with focus on annuity, ULIPs and non- participating products,” says Gopal Kumar, Actuary with Radgo & Company.

“The base effect may not be very strong as the number in August compared to the pre pandemic period (August 2019) is also higher. Compared to August 2019, NBP of life insurers in August 2021 is higher by 18 percent,” he added.

Again, buoyant capital markets supporting ULIPs and strong momentum in non-par and annuities are the likely drivers. It was despite the fact that the country’s life insurance behemoth LIC had a weak performance, a Kotak study revealed.

Among the key players, SBI Life and ICICI Prudential reported strong 67 percent and 34 percent y-o-y growth in individual APE.

HDFC Life retained strong growth at 27 percent y-o-y. Max Life slowed down a bit, with individual APE up 9 percent y-o-y). Bajaj Allianz Life and Tata AIA Life reported strong 53 percent and 37 percent y-o-y growth respectively.

“We have seen a gradual pick-up over the past few months, and August has witnessed robust growth trends across the industry with a focus on annuity, non-par and ULIPs. Given the demographics and market under penetration, continued easing of restrictions and opening of the economy, the life insurance premiums are expected to witness significant movement in FY22,” a report by Care Ratings said.

Key risks such as a delay in the economic recovery and resurgence of Covid cases i.e., a third wave could negatively impact premium growth, and rise in the premium rates

of term plans, it added.

As base effect gradually recedes, y-o-y growth is likely to taper down although strong demand for select products (ULIPs and non-par) is expected to support robust growth over the next few months.

While the overall individual APE for LIC declined 5 percent y-o-y in August (down 4 percent y-o-y in July and up 1 percent y-o-y in June), LIC’s base is higher than private players. Two-year individual AEP CAGR was weak at negatvie 2 percent versus 14 per cent for private peers. Robust 18 percent y-o-y growth in group APE, however, led to a muted 2 percent y-o-y growth in overall APE.

Commenting on it, Kamaljit Sahay, former MD & CEO of Star Union Dai-ichi Life Insurance and a former advisor of GIC Re said, the slump for LIC is likely to be a very temporary setback.

During the latter half of the year, LIC will regain its usual growth rate and market share, Sahay said.

HDFC Life Insurance which recently acquired Exide Life Insurance, reported a 17 percent y-o-y growth in overall APE led by strong 27 percent y-o-y growth in individual APE even as group APE was down 32 percent y-o-y. Two-year individual APE CAGR at 20 percent was higher than average of private peers at 14 per cent. Sharp decline in group APE likely reflects cautious stance in the group term business.

ICICI Prudential Life’s recovery is well on track. The company reported 36 percent y-o-y growth in overall APE led by 34

percent y-o-y growth in individual APE and 59 percent y-o-y growth in group APE. Interestingly, group APE is down by 1 percent y-o-y for its peers. Product mix diversification and new bancassurance partnerships have led to gradual revival in APE.

The company had highlighted in recent earnings call about its strategy to focus on group products.

In case of Max Life, individual APE slowed down. The company reported modest 9 percent y-o-y growth in individual APE; 10 percent two-year individual for August and 6 percent for July is lower than average for private peers at 14 percent and 10 percent growth, respectively.

Even as Max Life outperformed the industry on growth since the start of the pandemic, the company seems to have slowed down a bit over the past three months. Group APE was up 70 percent y-o-y (up 115 percent y-o-y in July).

“Most of the life insurance companies have been able to increase or retain the persistency to the expected level. This would lead to increase in gross written premium and embedded value of life insurance companies”, Bal from SBI Life added.

SBI Life has also reported robust numbers. The company reported a strong 67 percent y-o-y growth in individual APE. Two-year individual APE CAGR of 20 percent for August and 14 percent for July are significantly higher than private peers. Individual business market share of 14.1 percent for five months of FY22 is higher than 3-13 percent over the past decade. Group APE,

however, dropped 19 percent y-o-y, leading to 58 percent y-o-y growth in overall APE.

Bajaj Allianz Life and Tata AIA Life remain strong during the period under review. Both the companies continued to report strong growth; two-year individual APE CAGR of 31 percent and 35 percent, respectively reflect penetration into bancassurance partnerships and product diversification. Bajaj’s group APE was up 23 percent y-o-y while Tata AIA’s group APE jumped 260 percent y-o-y.

“We have seen a gradual pick-up in growth over the past few months, with August witnessing healthy trends across most players. With the continued easing of restrictions and opening up of the economy, we expect premium growth to see strong traction over FY22, with a continued focus on Non-PAR/Annuity, while ULIP will witness a gradual recovery,” a report by Motilal Oswal Financial Services said.

EoM.

(Kumud Das is a Pune-based teacher and freelance journalist, who writes on insurance, banking and human interest stories)