With the second wave of Covid raging across the country there has been an unparalleled surge in Coronavirus-related health insurance claims. Vidal Health, one of India’s leading third-party administrators, is working to help policyholders find hospital beds and ICUs besides guiding them to the nearest diagnostic centres in line with their policy coverages. In an interaction with Moneymonc, Girish Rao, Chairman & Managing Director, Vidal Health, discusses the most common exclusions in Covid hospitalisation bill, telemedicine, the correct way to file a health insurance claim and more. Excerpts:

1. How is Vidal Healthcare helping customers, especially in keeping costs low amid the pandemic?

Given that the treatment rates for COVID are not standardised in India, the costs can range from Rs2 lakh to Rs3 lakh. We are helping policyholders find hospitals where the treatment cost will fit their sum insured so that they do not burn the sum insured too quickly. This helps the policyholder make an informed financial choice in addition to the clinical choice they want to make.

It is a difficult time in terms of operations on the ground. So we have diverted our internal resources to augment the capacity and expanded the support/call centre team that provides aid to policyholders and employees of large corporates.

2. What are the most common exclusions in the bill settled under Covid by insurers?

Typically, it is all the non-clinical items that don’t get covered in the standard health insurance policy. Consumables for one-time use such as gloves, masks etc. are not covered. Since PPE is an important component of caregiving in the hospital environment treating Covid patients, it is now covered by the insurance companies.

The challenge that we are facing is the number of consumables that come into the picture since there is no defined protocol around this. There have been cases where we’ve got a bill where a customer was charged 100 PPEs for a 3-day hospitalisation which is impossible to accept. Most importantly, the consumer must be aware that anything that is non-clinical is not payable. However, given the unprecedented situation, even insurers are stretching out and paying for consumables within the limit.

Largely, all insurance companies are supporting both telemedicine in terms of digital consultation and home care because in certain cases the cost of home care is also quite high.

However, there is a subtle difference between what is paid and what is not. If it’s a very minor case, then those don’t get paid, however, if it’s a little more complex case, and you’ve been given expensive medication, and have had to recuperate at home because of lack of beds, then those cases are getting paid. Therefore, I think it is important to reach out to the insurance company and TPA and evaluate whether your case is reimbursable.

3. Why it is important to reach out to your TPA/ insurer?

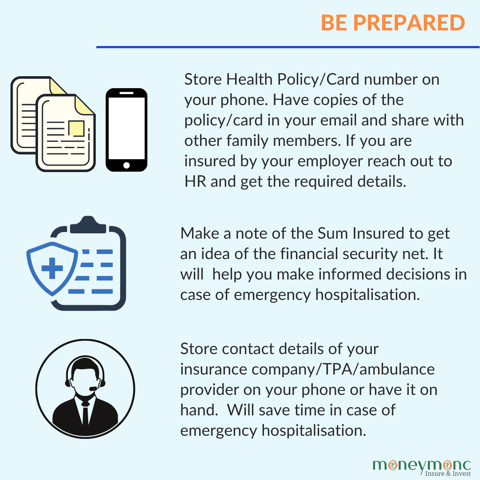

Given the current situation, there is a lot of anxiety and the focus is on getting the patient to the hospital. Therefore, reaching out and informing the insurer/ TPA through the pre-authorisation route will help augment that process.

It will ensure that the TPA reaches out to the hospital and accelerates the process of admission and facilitate seamless admission even before the patient reaches the hospital. This will help minimize the process and it becomes easier for the caregiver/patient to avail cashless facility.

I am aware that some hospitals are denying cashless facility. To be fair, in some hospitals, on a particular day, because of the pressure of COVID admissions, some of them might request the patient to get admitted right away and seek reimbursement from the insurer subsequently. The best way to avoid this situation is to call the insurer and seek pre-authorization on the way to the hospital. I know it is a task amid the trauma and anxiety, but if they just make a call to their insurance provider/TPA, will help speed up the process and make sure that the pre-authorisation for cashless treatment is given in advance.

4. What are the important steps for registration of a covid health insurance claim as per Vidal Health?

Ensure all the clinical documentation is in order once you’ve been discharged. I think the grey area for the claims that go back and forth is that the need for admission is not clearly defined. For a smooth claim settlement process, one must ensure that there is clear clinical evidence in the documents that the admission was required and that it was not a mild symptom.

In fact, if one has mild symptoms, it is better to stay at home and get cured rather than occupy a bed, which could then be available for somebody whose condition is more severe and needs urgent clinical attention.

However, if the patient gets the discharge and clinical document correct where the need for admission is clearly defined with other requisite COVID data these claims will be paid.

Today insurance companies/TPAs are very sensitised and the majority of these claims are being processed within five days of receiving.

5. Are you seeing claims being lodged for mental health issues?

There is a lot of discussion about mental health. I’m seeing a lot of corporates, stakeholders reach out to us and talk about mental health challenges that they’re facing. Again, the credit must go to IRDA for taking the lead and advising all insurance companies to pursue mental health very carefully and make sure that mental health is covered under health policies. However, we haven’t seen too many mental health claims come through due to the stigma around mental health in our country.

In our organization, we are seeing a rise in mental health cases and HR is trying to deal with it esp. employees working round the clock to ensure patients in need are able to get the admission in the hospitals and right medication. There is sense of helplessness all around and so there is a lot of mental fatigue and mental stress. However, we are not seeing as many claims, partly due to lack of awareness and partly due the stigma surrounding it.

(Chandni Arora is a Jodhpur-based writer, who writes on Insurance, culture and lifestyle.)