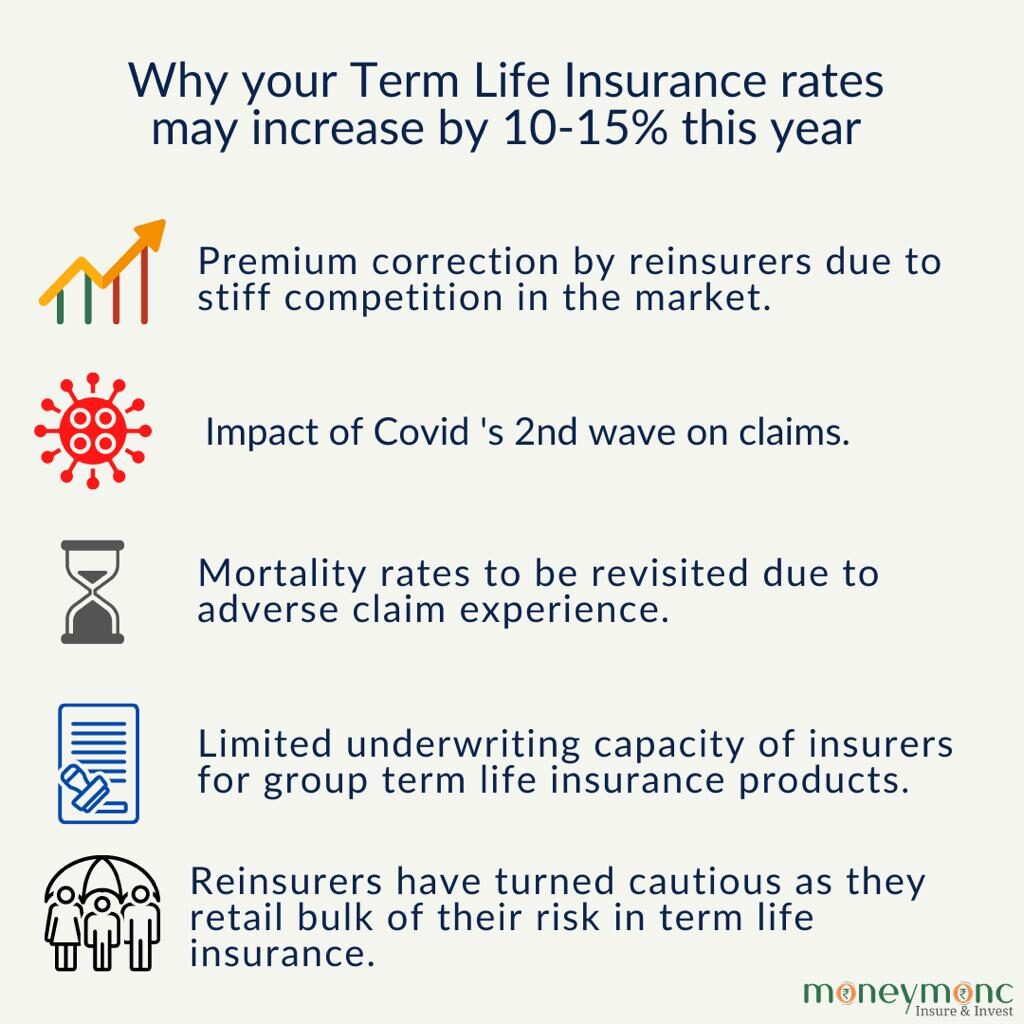

Faced with rising life insurance claims amid the second wave of Covid-19, life insurers are likely to go for a second round of increase in term life insurance rates in July 2021.

Term life insurance rates are likely to go up by 10 to 15 per cent during the second half of FY21, said a senior official from a private life insurance company.

In March, most life insurers had already raised term life insurance rates by as much as 50 to 100 per cent as reinsurers had increased their charges for all new policies sold.

Akshay Dhand, Appointed Actuary, Canara HSBC Oriental Bank of Commerce Life Insurance said the term life insurance rates in India had become significantly low owing to the stiff competition between insurers and pressure from web aggregators and other insurance intermediaries.

“However, as the customer base for these products has widened; there has been deterioration in the actual mortality experience of these products versus what they were priced at. This prompted the reinsurers, who were retaining bulk of the risk under these products, to raise rates at the beginning of the last year,” he told Moneymonc.

Incidentally, mortality tables used to price and construct life insurance policies are also expected to be revisited. A mortality table, also known as a life table or actuarial table, shows the rate of deaths occurring in a defined population during a selected time interval, or survival rates from birth to death.

Manoj Jain, MD, Shriram Life insurance said, “Certainly, there is an impact on expected mortality in India due to the second wave of the pandemic, which is not only affecting families with loss of lives but is also causing financial and mental distress.”

Considering the current spike in Corona and related casualties, we may expect a correction in reinsurance rates down the line, which will, in turn, increase the pure term plan rates in India, Jain said.

Since the mortality is specifically seen in the ages which are eligible for term insurance, the mortality tables may be revisited. “As most of the term plans are reinsured, reinsurance companies are able to arrive at the age-wise mortality rates.”

However, life insurers say that an increase in term life insurance rates was on the cards even before the second wave. As Dhand adds, “There were already talks of a second round of increase by reinsurers as the initial increase in reinsurance rates was turning out to be inadequate.”

Hence one could have expected further increases in term premiums over this year. “However, it is important to note that this particular increase was already on the cards before the second wave of COVID-19 hit the country in April and it is quite possible that the eventual increase is further exasperated due to this second wave.”

The eventual increase in rates is likely to vary from company to company.

Dhand says the hike will critically depend upon factors such as how competitive their rates were in the first place vis-à-vis how much they have increased their rates over the last year, what is their term business strategy and how much business they actually write or would be writing in this segment etc.

Interestingly, in group term life insurance, many corporates keen to have a cover for their employees are unable to secure one as life insurers have turned very strict with group underwriting of large contracts. This is because reinsurers have turned increasingly cautious with increasing claims.

According to T. L. Arunachalam, Director and Head – Cyber & Emerging Risks Practice from Bharat Re, “Enquiries on group term life insurance are on an all-time high, but the problem is that the insurance industry has limited capital and life insurers have seen the maximum pay-outs in claims because of the unfortunate demise of people due to COVID 19. So, while on one hand there is a huge rush of corporates to buy group term life, on the other, underwriting capacity is not available.”

According to recent media reports, some insurers have started insisting on vaccination certificates. However, insurers that Moneymonc spoke to have denied these reports.

With stricter underwriting after the second wave of the Covid19 pandemic in India, life insurers are closely evaluating every life insurance proposal and therefore, getting a term life insurance policy is likely to be pricier and a lengthier process than ever before.