Smartcoin, an app-based consumer lending platform, was one of the several businesses that faced a lot of disruption during the pandemic. Even good borrowers who wanted to repay were unable or unwilling to do so. During the lockdown, they found that many borrowers were trying to hold on to cash because they were worried about possible Covid expenses.

The start-up reached out to them and provided health insurance solutions by partnering with insurers, giving them an option against EMI postponement. Once this began, borrowers began to make repayments.

For a huge section of the Indian middle- and lower-income salaried segment, the borrowing options are few. They are forced to borrow from friends, relatives or moneylenders for emergencies as banks typically don’t cater to this segment.

Broadly, this category consists of small shopkeepers, small home business owners, and people working in the gig economy (i.e. car owners serving on Ola and Uber or people working as delivery personnel for food delivery companies, e-tailers, etc). Their number is estimated at over 40 crore.

Smartcoin was started by IIT/IIM alumnus Rohit Garg, Amit Chandel, Vinay Kumar Singh, and Jayant Upadhyay to cater to the credit requirements of this segment.

Rohit Garg, Co-founder & CEO of Smartcoin said that they provide smaller loans or micro-loans (from Rs 1,000 to Rs 1 lakh) for tenure of 2 months to 12 months. The company has a mobile app on Google Playstore that anyone can download where the entire borrowing process is digitised. Users can complete the application online through the app and get money directly into their bank account. There is no paperwork and the entire process takes roughly a few minutes to a few hours.

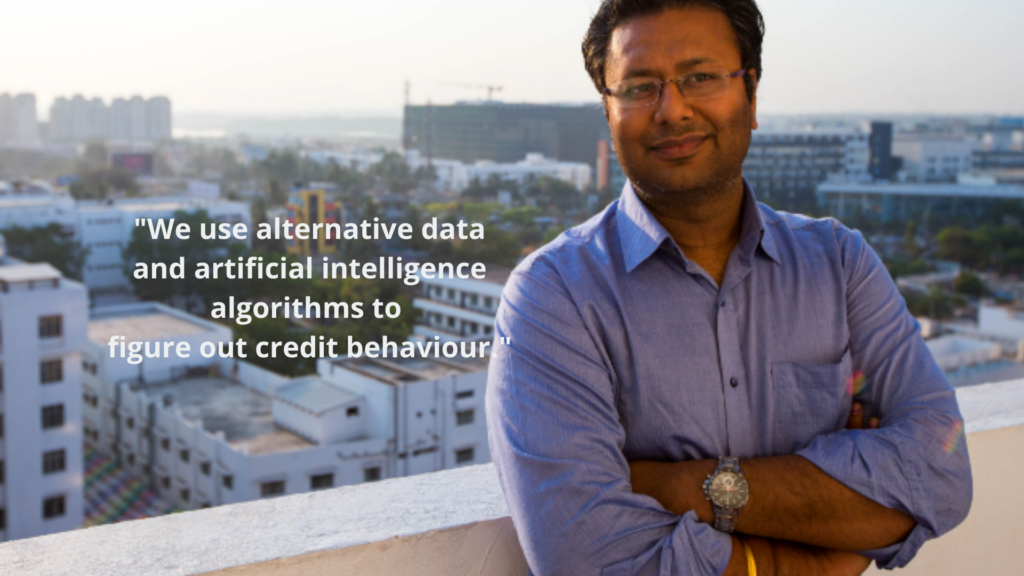

“At our end, we have simplified the borrowing process immensely. Thus, at the customer end, the process is intuitive. The magic happens behind the scene. Most of the borrowers don’t have credit scores or other data on which lending decisions are made, so we use alternative data and artificial intelligence algorithms to figure out credit behaviour. That is our in-house technology,” Garg said.

The company has spent a lot of time working on getting its fraud and intent engine right so it is able to clearly differentiate between people who don’t want to repay and people who are unable to repay because of circumstances.

Smartcoin’s in-house technology helps filter people who don’t intend to repay their loans. Smartcoin’s collection rates are currently above 95 percent and have been improving over time.

Garg says when they started in 2016 investors were cagey about their approach of lending money pan-India without collateral. But today, their app has close to 60 lakh downloads on the PlayStore.

The start-up has so far issued over 15 lakh loans and disbursed Rs 600 crore across the country, including the Andaman and Nicobar Islands.

Overall, the company has serviced over 17,000 of the country’s 21,000 PIN codes. The interest rate charged is 2-3 percent per month; so for instance, on an amount of Rs 10,000, the EMI works out to Rs 200-300.

The reasons for borrowing vary greatly, from a shopkeeper who needs Rs 30,000 to stock more inventory to a delivery boy who needs Rs 2,000 to buy petrol for the day to somebody who needs Rs 5,000 – 20,000 to get a medical procedure done to children’s tuition or personal education. Sometimes, the loans are used to buy consumer durables or electronic goods.

However, Garg says the loan amounts in the sub-Rs 10,000 category are concentrated around medical emergencies. “This was especially so when Covid fear was at its peak, but it is still a big use case even today.”

Another reason for small loans is the typical month-end cash crunch. Bill payments are another big driver. “People who have bills due on the 25th and expect receivables or salary to be credited on the 30th tap our app. Bigger loans of say between Rs 30,000 and Rs 60,000, we find, are used for shop renovation or business expansion,” he adds.

The start-up is also looking at partnering and is in active talks with some banks to work with them on the capital, the acquisition and even collection side.

(Mandar M Bakre is a Pune-based freelancer with more than 15 years in journalism and communication, primarily in the business domain)