There are 30 health insurance providers in India, and if you decide to opt for the company with the highest market share in the general insurance space, then New India Assurance will be your insurer of choice. Based on your requirements – whether you are single, married, want to cover your parents or are a senior citizen, the following health plans from New India can be looked at:

New India Premier Mediclaim Policy

This is a premier cashless Mediclaim policy. If you’re an individual looking for high-end sum insured options or a married couple who want to invest in a health insurance policy that offers a great coverage at a decent premium, you can consider buying this policy. It provides you with coverage for hospitalisation expenses, hospital cash benefit, critical care benefit, OPD benefits for procedures named in the policy (after every block of two continuous claim free years), new born baby cover, infertility cover, AYUSH treatment – to name a few. The policy can be extended to cover dependant children and parents as well.

The New India Premier Mediclaim Policy offers 4 sum insured options for you to choose from – 15 lakh, 25 lakh, 50 lakh and 1Cr.

The premium breakup inclusive of GST for both primary and secondary member is as below:

Source* – New India

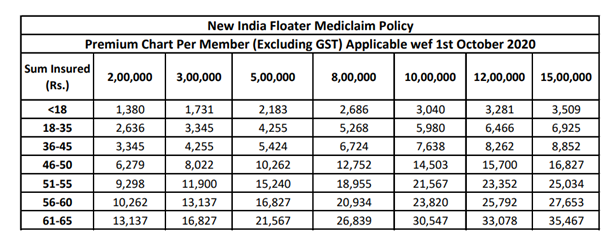

The New India Floater Mediclaim Policy

This policy offers you a wide range of sum insured options as per your risk exposure and needs that range from Rs2lakh to 3, 5, 8, 10, 12 and Rs 15 lakh. All the members you wish to cover under the policy can avail single sum insured towards hospitalization expenses on a floater basis. The policy can be availed by a minimum of two family members and a maximum of six members and offers cashless services.

Under the New India Floater Mediclaim Policy you can avail covers for hospitalsation expenses, hospital cash, new born baby cover, cataract cover, AYUSH cover to name a few. Further 139 daycare procedures are covered in the policy. The premium breakup inclusive of GST for the basic policy coverage is as below:

Source: New India

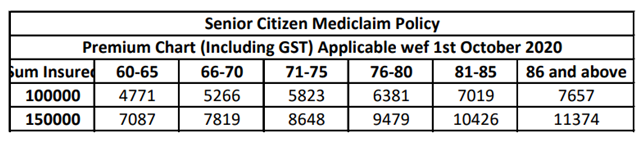

New India Senior Citizen Mediclaim Policy

This policy offers a very basic coverage to senior citizens with sum-insured options of Rs1 lakh and Rs1.5 lakh on a reimbursement basis along with pre and post hospitalization benefits of 30 and 60 days respectively.

This coverage can be opted by you as a senior citizen/for your parents if you/they are considerably healthy, live in tier II/III cities and don’t require higher treatment costs, or if you have a top-up cover in place for them. This is because the policy offers low sum insured options and doesn’t provide cashless benefits, which means that the treatment will have to be first borne by you, and then the claim related documents need to be submitted to the company for getting reimbursed.

The premium breakup inclusive of GST is as below:

Source: New India

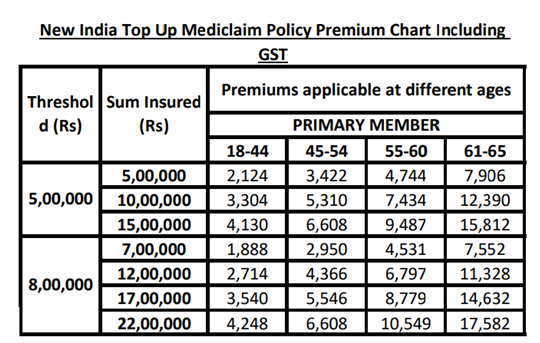

New India Top Up Policy

New India Top-up Mediclaim policy covers hospitalization expenses once it crosses the threshold limit of Rs5 lakh or Rs8 lakh. The threshold limit can be met either by a health insurance policy or by self-funding, i.e. it is not mandatory to have a base policy to buy a Top-Up Mediclaim Policy.

The policy can be issued on Individual or Floater Sum Insured basis covering up to 6 members of the family where the entry age the proposer can range from 18 to 65 years and for the other members it ranges from 3 months to 65 years and can be renewed for a lifetime. The premium breakup is as shown below:

Source: New India

So How To Go About It?

New India is one of the largest and longest surviving insurance companies of India. While it offers a wide range of products, it will be beneficial for you to check out the following points before opting for the company as your health insurance provider:

- The premium rates by New India are competitive, but check if the coverage suits your needs. If the out of pocket expense in the event of a medical exigency is higher because of you being underinsured, having a health insurance policy would not be a great relief.

- Check if the policy is offering you cashless facility. Also, check the network hospitals around your area of residence that have tied up with the company for offering this benefit. If there are other health insurers with more network hospitals, it is always advisable to go with them for hassle free claims settlements.

- There are insurance providers with better and wider sum insured options for health insurance for senior citizens and in terms of a super top up policy. Ask your agent/do an online research before buying a policy, to avail a coverage that best suits your requirement.

- Check the health of your insurance company and its claims paying ability while you lodge a claim. You can check this article by MoneyMonc for a better understanding. (link article health of your health insurer here)

(Elizabeth Mathai is a Kochi-based content creator and a therapist, with expertise in insurance)