When 34-year-old Mukund Narayan, employed with a leading global tech company, lost his job to the global downsizing at his company, he found himself without any health insurance cover as well. And when he and his wife unfortunately got infected with the Coronavirus, they were forced to shell out money Rs6 lakh for their 20-day stay in the hospital. Without an insurance cover, the amount spent on treatment made a huge dent into their lifetime financial savings.

One of the biggest mistakes that most individuals make is to feel a sense of security because of their company’s health insurance policy.

Sadly, this is not an uncommon scenario today.

Group health insurance comes with many advantages – coverage from day one for pre-existing illnesses, maternity cover, also a parental cover is offered by several companies with the biggest advantage being that the premium cost is borne by the employer. So, most people avoid buying a health insurance policy outside that.

However, a job-loss can happen to anyone and if, unfortunately, a medical emergency or an illness strikes, it can play out into a very tough situation. This is because the treatment for Coronavirus can run into lakhs for a family.

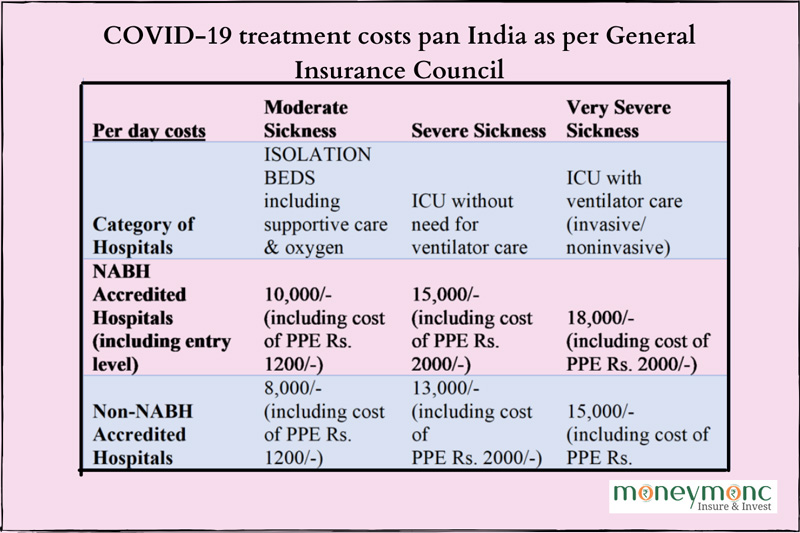

Here is a chart on the treatment costs pan India for Coronavirus as per the General Insurance Council:

Incidentally, the Covid-19 pandemic has thrown the much-needed spotlight on health insurance in India. In the post-pandemic phase, there has been a huge momentum from individuals buying policies. Historically, health insurance in India has been driven by ‘group policies’, or organisations buying and offering health insurance as a benefit offering to their employees.

After the pandemic, the government has also made it mandatory for employers to provide health insurance cover to employees if they continue operating post the coronavirus lockdown in the country.

Previously while many employers were providing coverage to their employees under group health insurance, it was not compulsory until now.

After the first few months of the lockdown, the number of individuals buying health insurance incidentally did see a surge. According to data from the General Insurance Council, premiums paid on individual policies increased by 31% during the April- November 2020 compared to the year-ago period, against 11% on group policies.

While this trend shows that retail health as a category has finally been seeing good traction, it’s still a relatively small drop in the ocean with group health insurance being the dominant cover for most Indians.

Advantages of buying a retail health policy

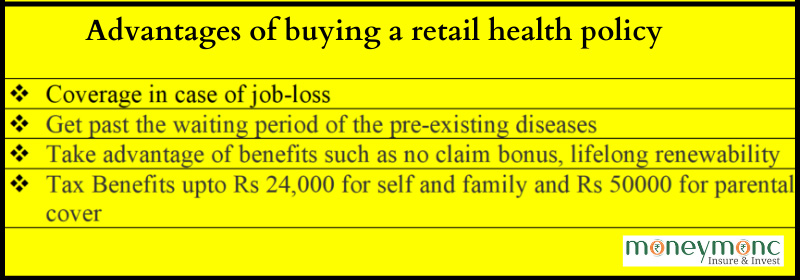

Buying a retail health insurance policy when young ensures that one can get past the waiting period of the pre-existing diseases and take advantage of benefits such as no claim bonus besides lifelong renewability, and tax benefits (under Section 80D).

An individual can claim a deduction of Rs25,000 under section 80D on insurance for self, spouse and dependent children. An additional deduction for insurance of parents is available up to Rs25,000, if they are less than 60 years of age. If the parents are aged above 60, the deduction amount is Rs50,000.

Drawbacks of individual health insurance

However, an individual health insurance cover does come with its set of drawbacks. Most insurers have a waiting period of 4 years for any pre-existing disease and maternity cover needs to be bought as an add-on cover separately. So, for instance, a maternity claim maybe restricted to Rs15,000 after the waiting period which can range from 2 years to 6 years. In group health insurance, most policies offer it from the day it is allotted to you.

According to Amit Chhabra, Health Business Head, Policybazaar.com, “While individual health covers are applicable at all times and circumstances, group health insurance plans only offer coverage until you are employed and your employer is paying the premium amount.”

Often individuals overlook the key limitation of group insurance cover that it is associated with employment.

“The time you change your employer or retire, you lose all your policy benefits; you do not have the choice of converting the group health cover to individual health policy. At such times, you might be required to opt for insurance cover at a higher age,” Chhabra says.

Despite some of the drawbacks of having an individual health insurance policy, having your own medical insurance plan over and above any policy that may cover you during employment and continues to offer coverage after you leave your job or retirement also can act as an important safety net in extraordinary situations that one may face.

Interestingly, after the introduction of Coronavirus specific health insurance products – Corona Rakshak and Corona Kavach, people who earlier were not able to afford the comprehensive policies were then buying COVID specific products. Over 30 lakh of specialszed Corona policies have been bought by consumers, that has given them protection and peace of mind at a time when health concern is most pressing, said PolizyBazaar.

Having an individual health insurance cover is therefore a must to protect your finances against any unforeseen expenses related to health emergencies.

(Deepa Nair is a Mumbai-based journalist specialising in finance and international affairs.)