The year 2020 has arguably been one of the most difficult years for mankind because of the Coronavirus pandemic and the consequent health hazards faced by the entire globe. As COVID-19 has demonstrated, pandemics are no respecters of age, wealth or status. So it is important to arm yourself with suitable financial protection. With rising medical costs – growing on the average at over 10 to 15 per cent every year – health insurance has become a must-have risk cover.

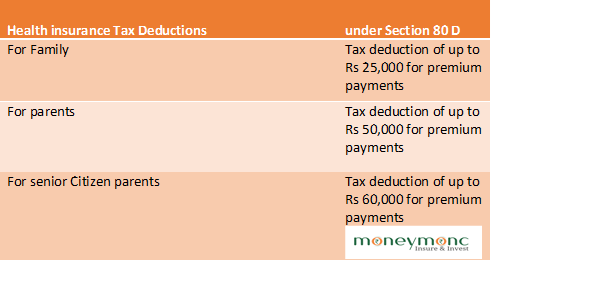

Apart from covering your medical expenses, health insurance also has substantial tax advantages under Section 80 D of the Income Tax Act. You can get a deduction of up to Rs 25,000 for premium payments under this section. That should help buy adequate cover for you and your family (spouse/children).

If you buy your parents medical cover – regardless of whether they are dependent on you or not, then you can get another Rs 25,000 off your taxable income. That’s a clear indication that the government wants to boost filial ties and encourage more young people to ensure adequate health insurance coverage for parents. There’s an additional Rs 5000 of deductions thrown in for medical check-ups as well another Rs 5,000 if your parents are senior citizens, adding up to Rs 60,000 if you claim all the deductions under this section.

Of course, the actual premiums that you pay may be dependent on a variety of other factors including your age, health, previous illnesses if any, and even the availability of group medical cover provided by employers for the salaried class.

Speak to your financial advisor about this and give yourself the basic protection required. There are always some things mentioned in the fine print (about what is allowed and what isn’t) and it’s better to read them or have someone explain it to you, so that you are not confronted with a surprise later on.

It’s also a good idea to preserve a copy of the premium payments and also file away your medical bills so as to enable you to claim the necessary deduction – either from your employer or from the tax authorities.

(N S Vageesh is a Mumbai-based freelance journalist, who writes on banking and insurance.)