Insurance is a tricky piece of paper. Not many of us understand the full terms and conditions before buying a policy. But when the need arises to make a claim, we dig into the documents and the real experience with the insurance cover begins. And those who didn’t fully understand the insurance policy at the time of purchase may discover that the coverage offered is not sufficient.

It is estimated that around 40 percent of customers go for insurance portability during their policy tenure especially when they are unhappy with the claims experience of their existing policy.

The topmost reasons for shifting to another player are better prices and better plan features.

However, these are not the only reasons why people look to port their existing insurance providers.

Pricing not the sole factor for portability

Adarsh Agarwal, Appointed Actuary, Digit Insurance, points out that the main reasons for porting of an insurance policy is seldom solely based on the product’s pricing. “A lot of times, policies are ported because of bad claims experience or because one’s insurance agent suggested another insurance policy/company. Sometimes there might be better insurance coverage offered by another insurance policy, enticing customers to port to it,” he adds.

According to Naval Goel, Founder & CEO, PolicyX.com, “The reasons may range from competitive prices, desirable riders, bad experiences or market responses received from peers. But the prominent reasons remain competitive pricing and waiting period for illnesses. In case a customer finds out that another company is having a lesser waiting period for particular diseases than their existing insurance service provider then they find the portability a good option.”

Bad claims experience

Every insurance policy is truly tested by the customer when they actually have a claim and if the experience is dissatisfactory, it can be a reason for the customer to port and not renew their existing policy.

Goel adds that the crucial factor which determines the renewal is the customer satisfaction and the experience gained during the policy duration as well as on raising the claim. “If a person hasn’t raised any claim in the last one year then it is most likely that the person would continue with the same policy and insurance service provider but in case a policyholder has raised a claim and didn’t receive a satisfactory response, then there are higher chances of the policy being ported to another service provider,” he said.

The marketing practices of the insurance companies claiming lower premium and highest sum insured also lures the customers at times and conveniences them to port to a new insurance company, said Goel from Policyx.com

Though there’s an overall increase in the number of policies being ported across the industry, it doesn’t account for more than 2.5 percent of the overall insurance business as most of the business is still written by an insurance company through new policies.

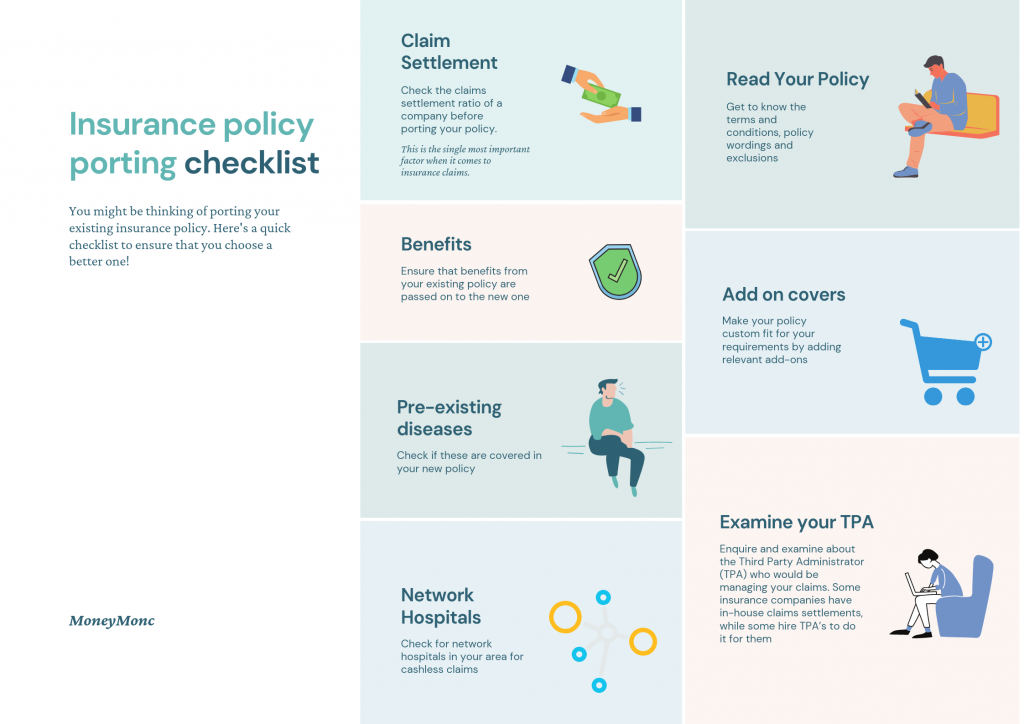

Having said that, what are the things to be kept in mind to choose a better policy while porting insurance? Nikhil Chopra, Chief Business Officer – Medi Assist Healthcare Services, has the following 7 suggestions:

- Check for the claims settlement ratio of a company before porting your insurance company. This is the single most important factor, because your entire experience of insurance depends on the way your claims are settled.

- Ensure that the benefit of your existing insurance policy carries onto the new one to which you are porting.

- Check if your pre-existing diseases are covered in the new policy or opt for a better coverage.

- Find out if the insurer has network hospitals in your area of residence for cashless hospitalization.

- Read through and understand policy limits/exclusions.

- Add the relevant add-on covers to your policy to make it custom fit for your financial requirements.

- Enquire and examine the Third Party Administrator (TPA) who would be managing your claims. Some insurance companies have in-house claims settlements, while some hire TPA’s to do it for them.

Goel from Policyx adds that porting an insurance plan is as important as buying one because it is done to get the better deal and higher advantages therefore there is an utmost need to read, compare and analyze the offering and other factors that are crucial for a policyholder, such as waiting period, the inclusion of pre-existing diseases, capping on different things such as sum insured, room rent etc. Hence, it is important to analyse and understand the coverages offered by your existing health insurance policy so that in case of an unfortunate event one is financially well protected for any sudden medical emergencies.

(Elizabeth Mathai is a Kochi-based content creator and a therapist, with expertise in insurance)