Parents are the ones who selflessly give all to their children and continue to do so throughout their lives. As they grow older, children need to ensure that parents retire happily and have the financial means to pursue their post-retirement goals. A good gift for parents enhances their financial security in the twilight years.

Here are a few gifting ideas for your parents, which will prove valuable for them forever:

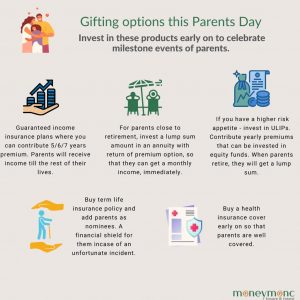

- Parents require monthly income in their sunset years post-retirement. So, if you have parents who are still working, you can gift them guaranteed income insurance plans

You can contribute 5 or 6 or 7 years’ premium and then your parents receive income for the rest of their lives.

The interest rate is more than that offered by bank fixed deposits and the interest is tax-free. This is a good option for those looking for assured guaranteed income, which will be available every year.

- Those with a higher risk appetite can invest in ULIPs, which have wealth maximisation as per defined goals. Children can contribute yearly premiums that can be invested in equity funds and over 5 to 7 years increase the corpus. Thus, when parents retire, they will get a lump sum that they and can invest in any way they want to supplement their income post-retirement.

- In case your parents are close to retirement, you can invest a lump sum amount in an annuity with a return of premium option so that they can get a monthly income immediately.

- Parents and children share a symbiotic relationship! It is visible in the form of role reversal once the children grow up. Parents who cared for their children’s needs are now being tended to by their children – physically, mentally and financially. Working children are always a source of support for their parents.

They can secure their parents’ old age by purchasing term insurance for themselves.

In case of any unfortunate event, parents will get the term insurance money to support themselves (in case parents are made the nominees for the life insurance policy).

- Medical costs have soared through the roof during the pandemic. It is only prudent that children buy health insurance for parents early on so that the parents are well covered. With age, she/he is bound to require health insurance. Therefore, health insurance must be taken as early as possible because once the parents become very old or have a lot of comorbidities, it’ll be difficult to avail of a relevant insurance policy and an affordable premium.

- As children, one would like to celebrate milestone events of their parents, such as 60th birthday or 50th wedding anniversary or 80th birthday or maybe take them for a pilgrimage or a world tour. These events are expensive if done on a grand scale – especially with extended family and friends.

As children, you can plan well in advance to finance these possible events by investing in ULIPs or any other saving products, which will give you good returns.

Therefore, it’s wise to start investing in these products early on, so that their big day can be celebrated in style.

This Parents Day let us pledge to make our parents financially secure. Let’s plan and act today to ensure they enjoy the sunset years of their lives.

Authored by –

Poonam Tandon

Chief Investment Officer

IndiaFirst Life Insurance Company Ltd