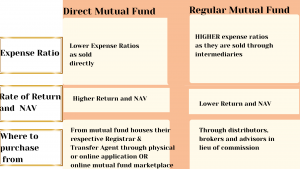

The direct plan and regular plan of any mutual fund scheme comes with the same investment strategy, objective, portfolio composition, asset allocation strategy and fund management team. However, these plans differ in terms of 3 aspects, namely – expense ratio, return rate and net asset value (NAV).

Let’s look closely at these three aspects and find out whether direct plans suit fresh investors.

Expense ratio

Expense ratio is the percentage of average daily net assets of mutual fund schemes utilized for meeting their annual operating expenses. Operating expenses involve numerous costs incurred on advertising, fund management, commissions, administration to the agents and distributors.

While regular plans are sold through distributors, brokers and advisors in lieu of commission, direct plans are directly sold by the AMCs or through online platforms and hence, does not involve any distribution cost. This leads direct plans to register lower expense ratios. Depending on the fund category, expense ratios of the direct plans can be up to 1% lower than their regular counterparts.

Return rate

As the savings generated in operating expenses by the direct plans remain invested, they begin to generate returns of their own. The power of compounding kicks in, which then widens the gap between the returns generated by direct and regular plans. For example, assume that you invest in a regular plan of an equity fund through monthly SIPs of Rs 20,000. With an annualized return rate of 12% and expense ratio of 2%, your corpus would grow to Rs 4.14 crore in 30 years. However, if the same monthly SIP of Rs 20,000 is invested in the direct plan of the same fund for the same time horizon, assuming expense ratio of 1%, your corpus would grow to Rs 5.17 crore after 30 years. The difference in the corpuses would amount to Rs 1.03 crore, with direct plan outperforming their regular counterpart by about 20%.

Net asset value

The NAV of a fund is calculated by dividing the fund’s net AUM with the number of outstanding units. The net AUM of a fund is calculated by deducting its various expenses and liabilities from total assets. As the direct plans have lower operating expenses than their regular counterparts, it leads direct plans to register higher NAVs than regular plans. Moreover, higher returns generated by the direct plans due to the power of compounding further helps them to register higher NAVs.

Where to purchase direct plans?

Investors have the option of purchasing direct plans from mutual fund houses and their respective Registrar & Transfer Agent (RTA), through physical or online application. However, this process may lead investors to apply with multiple fund houses or RTAs resulting in the duplication of paperwork or creation of multiple IDs and passwords, if opted for the online investing route.

Instead, investors can buy direct plans from online mutual fund marketplace or through independent financial advisors, after paying advisory charges. Such fees are directly paid to the advisor or concerned marketplace and are not deducted from the fund’s NAV.

Some online financial marketplaces offer direct plans without charging any advisory fees, maintenance expenses or other fees. Such marketplaces allows you the ease of investing and managing multiple mutual fund schemes through a single platform without incurring any additional cost.

Do direct plans suit fresh mutual fund investors?

Direct plans were initially introduced for Do-It-Yourself (DIY) investors, to save them from paying for the advisory services they may not require. However, this specific idea brought forward an incorrect notion that direct plans are not suitable for first time investors or the ones needing handholding when making investment decisions.

Some of the online financial marketplaces that offer direct plans provide personalized investment advisory services completely free of cost. Such platforms even provide free market insights and online calculators to allow informed investment decision making.

Sahil Arora is Director and Group Business Head – Investments and Credit Cards at Paisabazaar.com. Paisabazaar.com is part of PB Fintech that also owns India’s leading insurtech brand, PolicyBazaar.com.