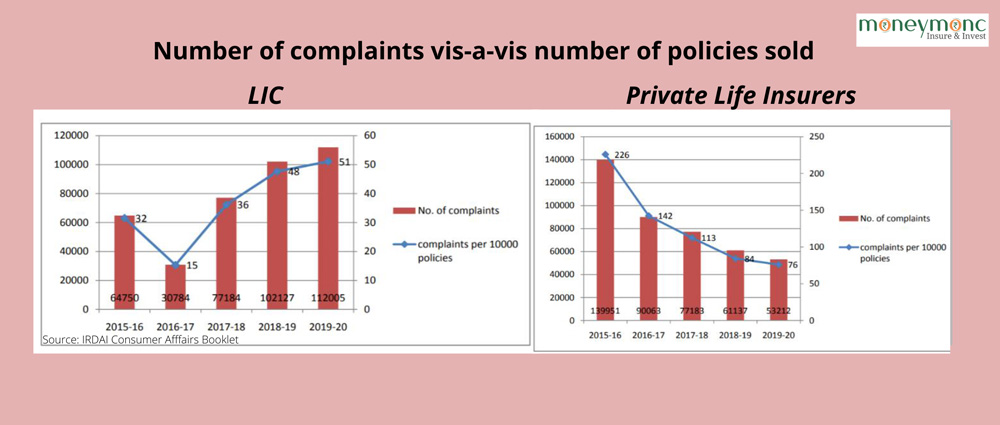

The country’s largest life insurer, Life Insurance Corporation of India (LIC) has been seeing a steady rise in the number of policyholder’s complaints over the last few years. This comes even as the private life insurance industry has seen a drop in complaints, according to the consumer affairs booklet released by the Insurance Regulatory and Development Authority of India (IRDAI).

LIC has seen a 72 percent rise in the number of policyholder’s complaints from 64,750 in FY16 to 1,12,005 in FY20, as per the booklet.

In contrast, private life insurers have seen a 62 percent reduction in the number of complaints — from 1,39,951 in 2015-16 to 53,212 in FY20.

On an overall basis too, incidence of complaints for every 10,000 policies has reduced by 19 percent between FY16 to FY20.

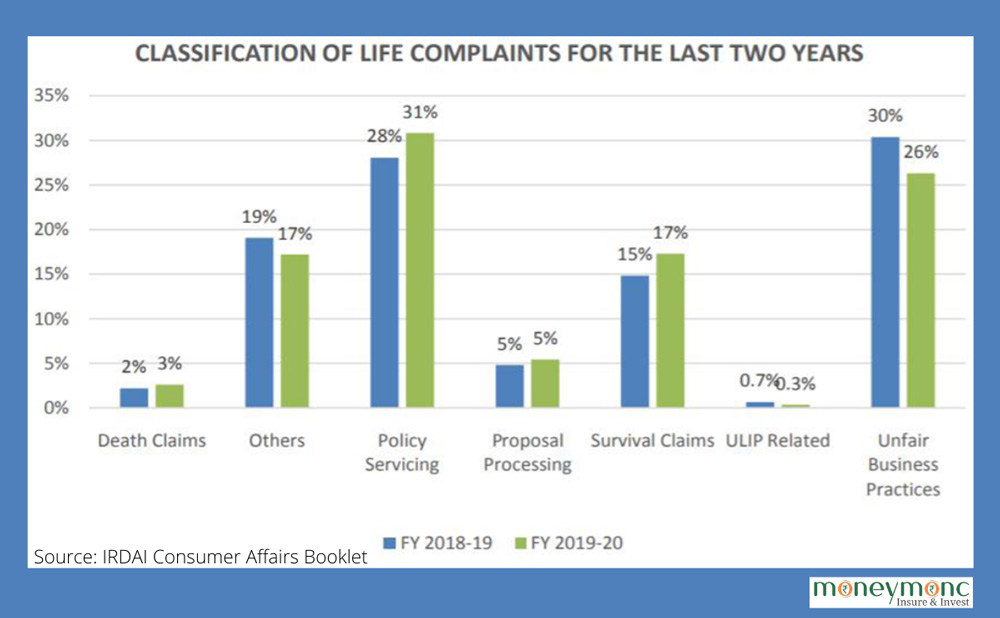

Interestingly, the category where the life insurance industry has seen a rise in complaints is policy servicing, where there has been a 3 percent rise during FY20 over FY19.

Categories such as unfair business practices and the Unit Linked Insurance Plan (ULIP) a type of insurance, which combines the benefits of protection and saving in a single plan, have seen a fall in complaints.

ULIPs had, in the past, earned a bad reputation owing to heavy charges. Things, however, improved after IRDAI released measures in 2019 for both ULIPs and traditional products that ensured that the commission rates were consistent with the premium payment term and also brought in transparency in terms of benefit pay-outs to enable the customers to choose the right policy.

Anand Pejawar, President – Operations, IT & International Business, SBI Life Insurance said, “Overall the life insurance industry has undertaken a lot of initiatives to improve the customer grievance of mis-selling. At SBI Life, we have also initiated significant steps like introducing the Audio Video Insta Pre-Issuance Welcome calls (Insta PIWC) and sending product details in audio visual format. All these initiatives have contributed to the reduction of mis-selling complaints.”

The insurance regulator has also made it mandatory to have a separate training for all the insurance agents/intermediaries before they are authorised to sell linked insurance products.

Atri Chakraborty, Chief Operating Officer, IndiaFirst Life Insurance, says there has been a specific focus on prevention of mis-selling and the company has created a robust training infrastructure for their sales teams, providing them technology-enabled tools to improve customer experience.

Overall, the number of complaints on unfair business practice and mis-selling has been on a declining trend over the past few years.

“In the current year also, there has been a 12.36 percent drop in the number of unfair business practices complaints over the previous year. This can be attributed largely to the IRDAI review of the grievance redressal machinery of all life insurers and the subsequent follow-up measures taken up by the regulator. The proportion of complaints on mis-selling to new policies has been on a declining trend over the past 5 years,” the report says.

Suresh Agarwal, Chief Distribution Officer, Kotak Mahindra Life Insurance, says the life insurance industry has consistently increased its focus on customer need analysis to ensure right selling.

Alongside, the persistency ratio (a measure of payment of renewal premiums by customers) has also evolved as one of the publicly available indicators of customer satisfaction, he adds.

During 2019-20, life insurance companies resolved 98.26 percent of the complaints handled, the booklet points out.