Often a customer is unaware about which health insurance policy is the best for her/him and where to buy it from. There are 34 general and health insurance companies in India and a choice is never easy. But every policyholder’s or buyer’s expectation from their insurer is simple: they need value for money and the trust they invest in the insurance policy. This is especially true during a claim when one expects seamless services in terms of claim registration, servicing and settlement.

Let’s Talk Claims

During 2019-20, General and Health Insurers settled 1.67 crore health insurance claims and paid Rs. 40,026 crore towards their settlement. The average amount paid per claim was Rs.23,866.

In terms of the number of claims settled, 70 percent of the claims were settled through Third Party Administrators and the balance through in-house mechanism. In terms of mode of settlement, 56 percent of the total claims were settled through cashless mode and another 40 percent through reimbursement mode.

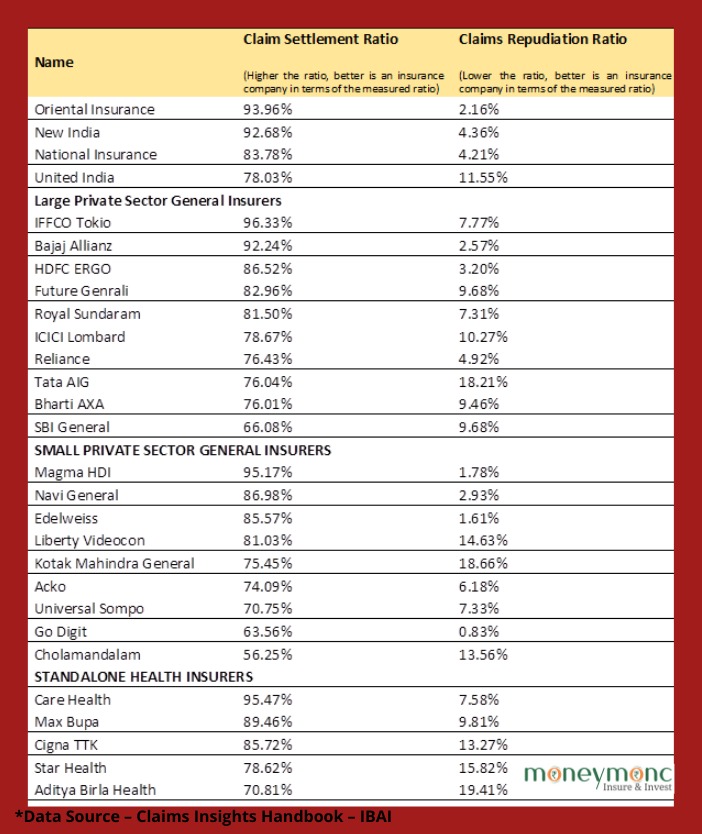

The below list collated by Insurance Brokers Association of India highlights the claims settlement ratio and the claims repudiation ratio of all the health insurers currently active in the Indian health insurance market.

But What About Insurance Related Customer Grievance

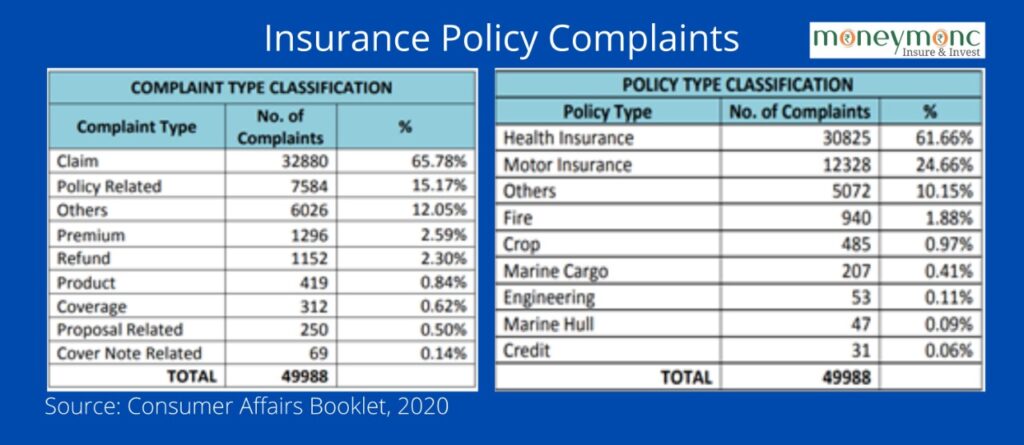

Every year, IRDAI comes out with its Consumer Affairs Booklet, wherein it highlights the grievances faced by the insurance customers in the past financial year. In the latest report, the summary of complaints, disposal and resolution by General Insurers for the period Apr 1, 2019 to Mar 31, 2020, shows that around 66 percent complaints are related to insurance claims, and close to 62 percent of the policies against which complaints are lodged are health insurance polices.

Going by the report we find that Magma HDI, Oriental Insurance, Bajaj Allianz General Insurance and New India Assurance top the chart when it comes to having a great claim settlement and low claim repudiation ratio. IFFCO Tokio and Care Health, maintained a good claims settlement ratio, but with a slightly higher repudiation ratio. On the other hand, companies like Cholamandalam, Kotak Mahindra, SBI General seem to be performing poorly as compared to the rest when both the ratios are looked at together.

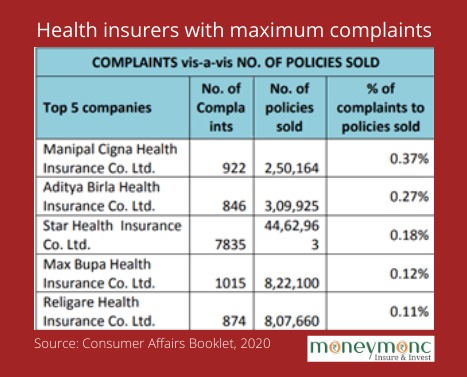

As per the same report, the top five companies with the highest number of complaints vis-a-vis number of policies sold are the standalone health insurance companies — Manipal Cigna, Aditya Birla, Star Health, Max Bupa and Religare. (refer table)

Major Causes of Grievances

When it came to health insurance grievances, a few common problems were observed which led to issues in health claims settlement. The major claim related complaints as per IRDA’s Integrated Grievance Management System (IGMS) are as follows:

- Insurer not disposing of the claim

- Difference between the amount claimed and the amount settled by the Insurer

- Insurer reduced the quantum of claim without providing proper reasons

- Insurer repudiated the claim due to alleged breach of policy condition/ warranty

- Claim repudiated without giving reasons

(Source: IRDAI’s Consumer Affairs Booklet)

While facing such issues ruins one’s insurance claims settlement experience, it is also important that customers get the basics of insurance right before investing in a health insurance policy. This includes reading the policy copy, understanding the coverage limitations, checking network hospitals in one’s area of residence with the insurer of their choice and most importantly disclosing their pre-existing conditions.

Additionally, opting for policies from insurers who have a higher claim settlement ratio and lower repudiation ratio (elucidated in the table above) as against settling for the cheapest insurance policy would ensure a smooth claims settlement experience in the wake of a medical emergency. Be prudent, choose wisely!

(Elizabeth Mathai is a Kochi-based content creator and a therapist, with expertise in insurance)

Pingback: MoneyMonc – Simplifying Insurance & Financial Planning for You