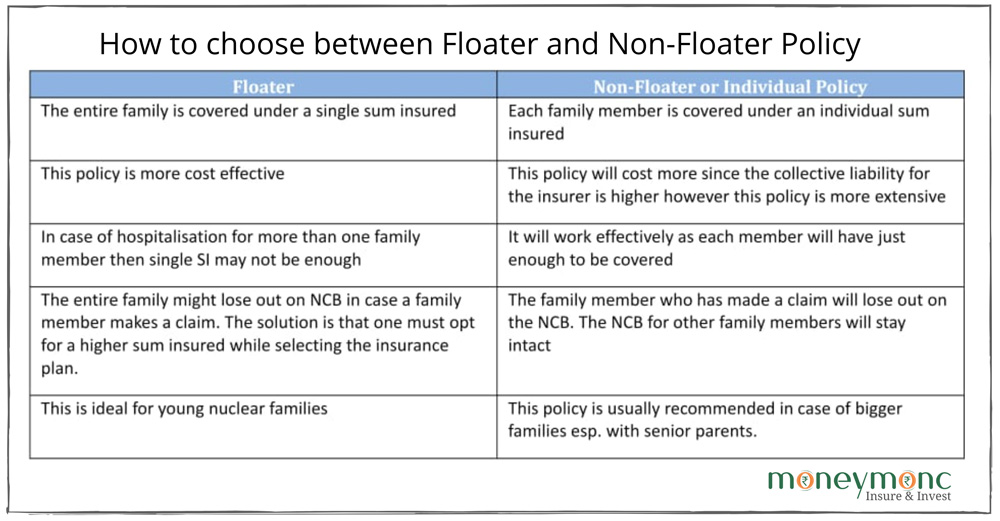

Every time you are shopping for a health insurance plan, a key decisive factor is whether to go for a floater or a non-floater policy. If you are not very well versed with insurance or are out shopping for a health insurance plan for the very first time, it could be confusing as well as unnerving to go through a gamut of jargons. Let’s make this simple for you so that you can make an informed decision without being intimidated.

Floater Health Insurance Plan

A Floater health insurance cover implies that all members of family are covered for a single sum insured with age of the eldest family member being the deciding factor when it comes to insurance premium.

Assume that a young couple with two kids opts for a floater health insurance plan with a sum insured of Rs 5 lakh. It implies that the entire family (of 4) will have to share this Rs5 lakh sum insured.

In case of a claim amounting to Rs 2 lakh the family, including the claimant, will be left with a sum insured of Rs 3 lakh for the rest of the year.

Non Floater Health Insurance Plan

A non-floater health insurance plan implies that every family member gets an individual sum insured and the premium is based on each individual’s age.

So if this family of four opts for a non-floater plan, then each member is individually covered for Rs5 lakh. The collective sum insured for the family will be Rs20 lakh in this case.

The floater/non- floater aspect of a health insurance policy, more or less, does not have any implications on the coverage and exclusions.

It is only a feature, which determines the maximum value for a particular year that the insurance company will have to pay to the individual or the family in case of hospitalisation.

What is important to keep in mind is not to let the premium be the deciding factor when it comes to finalising a health insurance plan. Instead one must ensure that all members of the family are adequately covered and get maximum benefit, while keeping in mind your financial health and rising medical inflation in mind.

(Chandni Arora is a Jodhpur-based writer, who writes on insurance, culture and lifestyle.)