Planning to buy or renew your life insurance policy? The most important thing in an insurance policy is the assurance of a good value proposition and smooth claim settlement experience in terms of servicing and settlement. Traditionally, the claim settlement ratio has been the most important parameter to select a life insurance provider.

The claim settlement ratio is a metric to gauge the percentage of life insurance claims an insurer has settled during a financial year against the number of claims it receives in the period including pending claims from last year.

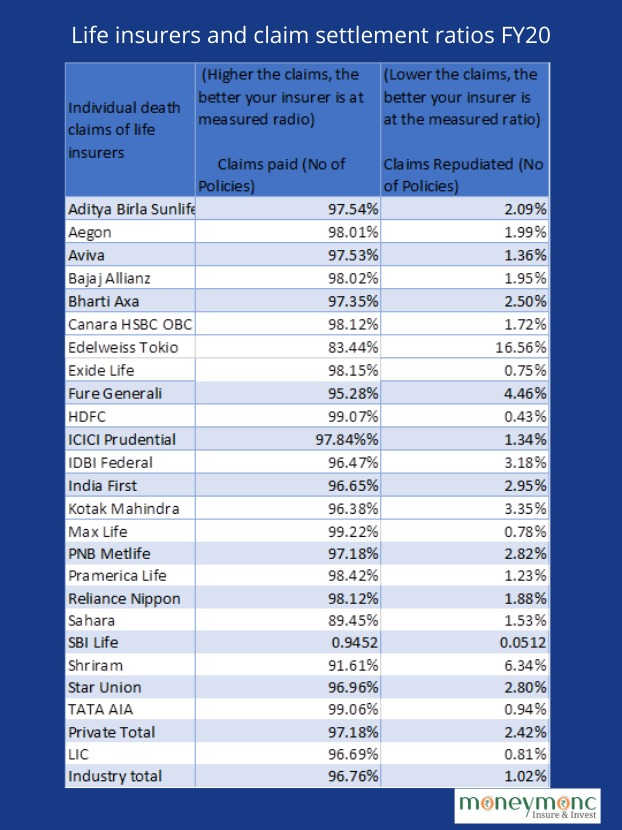

According to the latest annual report by the insurance regulator, Insurance Regulatory and Development Authority of India (IRDAI), the life insurance industry’s claim settlement ratio declined to 96.76 percent in 2019-20 from 97.64 percent in 2018- 19, implying a decline in the number of claims settled.

Claim settlement ratio of Life Insurance Corporation of India (LIC) was at 96.69 percent as at March 31, 2020 when compared to 97.79 percent as at March 31, 2019. The proportion of repudiations had increased to 0.81 percent in 2019-20 compared to that of 0.43 percent in previous year.

Also Read: How good is your health insurance company in settling claims and addressing grievances?

For private insurers, settlement ratio had increased to 97.18 percent during 2019-20 over 96.64 percent during the previous years. The repudiation ratio for the industry increased to 1.02 percent compared to that of 0.74 percent in 2018-19.

Incidentally, Aditya Birla Sunlife, Aegon Life, Aviva, Bajaj Allianz Life, Bharti AXA Life , Canara HSBC OBC Life , Exide Life, Future Generali, HDFC Life, ICICI Prudential Life, IDBI Federal Life, India First Life, Kotak Mahindra Life, Max Life, PNB Metlife, Pramerica Life, Reliance Nippon Life, Shriram Life, Star Union Life, TATA AIA Life all had a claim settlement ratio of over 90 percent in FY20 with the exceptions being Edelweiss Tokio Life and Sahara Life Insurance.

The below list collated by the insurance regulator in its annual report highlights the claims settlement ratio and the claims repudiation ratio of all the life insurers currently active in the Indian life insurance market.

The life insurance industry paid benefits of Rs 3.51 lakh crore in 2019-20 (Rs 3.30 lakh crore in 2018-19), which constitutes 61.21 percent of the gross premium underwritten.

Life insurance complaints

As reported in an earlier story by Moneymonc, the category where the life insurance industry has seen a rise in complaints is policy servicing, with a 3 percent rise during 2019-20 over 2018-19, according to the insurance regulator’s Consumer Affairs Booklet.

Categories such as unfair business practices and the Unit Linked Insurance Plan (ULIP) – a type of Insurance, which combines the benefits of protection and saving in a single plan – have seen a fall in complaints.

Assessing Parameters such as speed of response and service

Interestingly, Beshak.org, an independent consumer awareness platform for insurance buyers, recently created a ratings platform for term life insurance plans. Explaining the need for such research, Mahavir Chopra, founder and CEO said, “Neither Claim Settlement Ratio nor the Settlement Guarantee assures you a smooth claim settlement. On the other hand, we are reporting parameters like percentage of claims settled in 30 days, complaints received on claims, speed of response on Twitter, etc. These parameters reflect an insurer’s track record on claims settlement and service response.”

Chopra said their rating of term insurance plans is based on 100+ parameters extracted from IRDAI, insurer websites plus their own proprietary research. The value of each parameter is compared across insurers and converted into a relative score. Finally, the weighted average of this score gives the Beshak Star Rating for the Plan.

The best rated term plan, in Beshak ratings is the Max Life Smart Term plan, which in a 5 star rating parameter, has an overall rating of 4.3, with a 4.7 rating for claims experience, 3.5 in customer service and 4.3 for product benefits.

LIC’s tech term plan is rated 3.5 with claims experience rated at 4.2, customer service 3.3 and product benefits at 1.9.

It is therefore important to carefully evaluate not just the life insurer’s claim settlement ratio, but also analyse the exact value proposition that your life insurer offers to ensure you have a smooth and hassle-free process in case of a claim. Research well and make the right choice.

(Deepa Nair is a Mumbai-based journalist specialising in finance and international affairs.)