The recent budget had an announcement that was of interest to all tax payers and especially the entire salaried class. The government introduced a cap of Rs 2.5 lakh on the tax-free interest that employees could earn from their contribution to the Employees Provident Fund (EPF) and Unit linked insuranceplans (Ulips).

In other words, a person earning approximately up to Rs 21 lakhs per annum (and contributing 12 percent towards EPF) would get the benefit of tax-free interest. Anything over this limit would be taxed at the appropriate slab rate. The measure, government officials said, was being introduced to ensure a certain degree of equity among financial instruments.

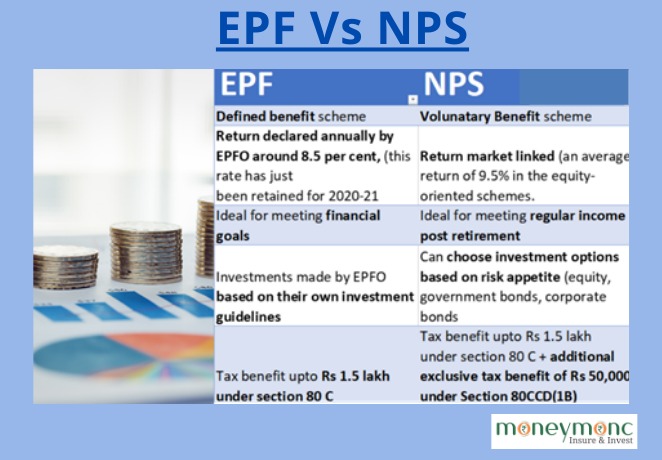

EPF Vs NPS

EPF scheme has so far been a popular savings scheme that helps people save up a sufficient corpus for retirement. Prior to the budget, EPF came under the category of Exempt, Exempt, Exempt (EEE) with regards to tax. However, from April 2021, subscribers will have to start paying taxes on their interest earned from the amount in excess of Rs 2.5 lakh.

Now, this may seem like a dampener for many high net word individuals (HNIs) who park their extra contributions (often beyond the 12 percent limit) in order to benefit from the tax break.

But it is not as though all doors are closed. It appears that the government may actually be tacitly signalling employees and other subscribers to look towards the National Pension Scheme (NPS).

For the goal of retirement planning and arranging for building a reasonable corpus, one can think in terms of moving surpluses to NPS.

What is NPS

NPS is a voluntary pension scheme with a minimum deposit limit in Tier I of Rs 500 and in Tier-II accounts of Rs 1,000, where the pension benefits are linked to the market as a higher proportion of investments can be allocated to equities. Thus, the returns of the NPS scheme are not fixed as they rely on the performance of the scheme manager and market. Subscribers are required to make voluntary contributions towards their NPS Account in order to accumulate a post-retirement corpus.

Financial planners do draw attention to the fact that there is a gradual move to close all avenues for tax-free investments. This only reiterates the importance of using whatever windows are still open to the extent possible. The PF scheme yields around 8.5 percent, (this rate has been retained for 2020-21 also).

NPS on the other hand has provided an average return of 9.5 percent in the equity-oriented schemes.

The diversity in the investment options available in NPS and higher ability to invest in equities and the flexibility to switch between funds (equity, government bonds, corporate bonds) provides the investor the freedom to switch funds based on their risk-appetite.

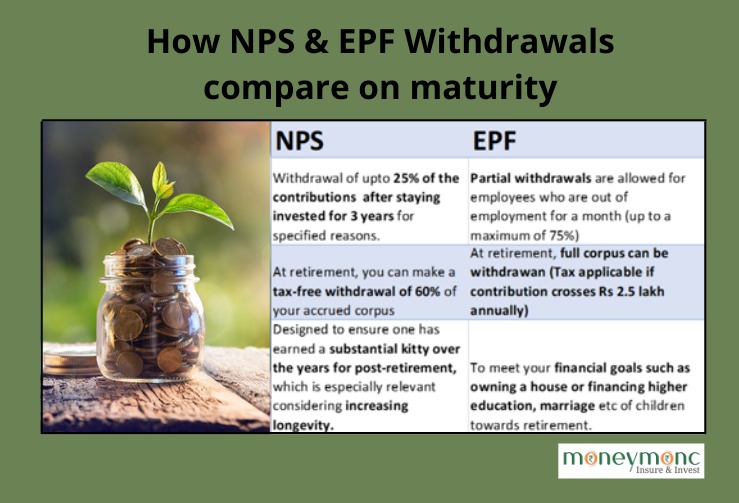

Withdrawal comparison on maturity

Since NPS is geared as a retirement scheme, it allows withdrawal of up to 25 percent of the contributions for specified reasons only after staying invested for 3 years. Also, at retirement, you can make a tax-free withdrawal of 60 percent of your accrued corpus. The remaining 40 percent has to be used to purchase an annuity product whose returns are taxed.

In PF, on the other hand, partial withdrawals are allowed for employees who are out of employment for a month (up to a maximum of 75 percent). Therefore, PF is an excellent scheme to meet your financial goals such as owning a house or financing higher education, marriage of children towards retirement.

However, for covering your retirement life, NPS is a scheme which has been specifically designed to ensure one has earned a substantial kitty over the years for post-retirement, which is especially relevant considering increasing longevity.

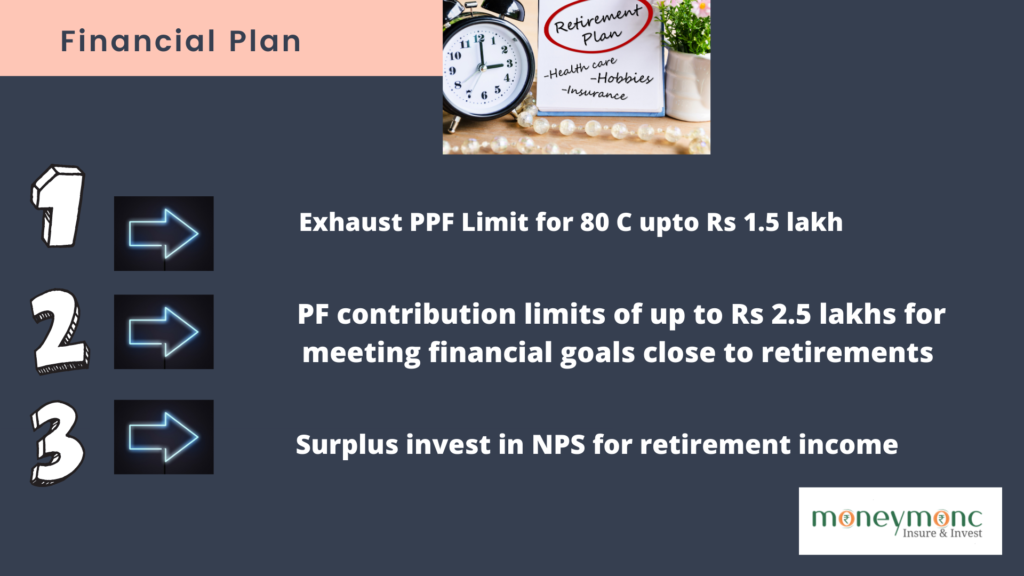

So, exhausting the PPF window of Rs 1.5 lakh per annum should be the first priority. This should then be followed by using the PF contribution limits of up to Rs 2.5 lakhs. And the surplus over that which was earlier part of the voluntary higher contribution (beyond the mandatory 12 per cent) can from here on be redirected to NPS option.

There is no limit on the investments in NPS. NPS also comes under tax deduction of Rs 1,50,000 under section 80 (C), which is typically exhausted as it is applicable to a whole bucket of investment options such as home loans, ELSS, PPF, EPF, Ulips. Additionally, it has an additional deduction for investment up to Rs. 50,000 under subsection 80CCD (1B).

Hence, retirement planning, tax savings and the ability to earn higher returns make NPS a very good option for long-term savings.

(Radhakrishnan Nair is currently a Trustee with National Pension Scheme Trust. He is former regulator having held positions of Member, Insurance Regulatory and Development Authority of India (IRDAI) and Executive Director at Securities and Exchange Board of India (SEBI).

(N S Vageesh is a Mumbai-based freelance journalist, who writes on banking and insurance)