Retirement now seems far away – in fact it might be nowhere on your horizon. But like death and taxes, old age too is a certainty. And unlike our grandparents, we might not be able to lean in on regular pension from a government job or the financial support from a joint family set-up.

The pension, or that assured monthly sum, a fraction of the last drawn pay in employment, was a source of great comfort – for the regularity and steadiness it provided to the monthly budget of the aging householder. That counted for something then – and does so even now.

So, if you want to get to your twilight years in some degree of comfort, then you had better save up from the word go when you start earning.

Put in money into the National Pension Scheme or NPS (if you are in the organized sector, as is most likely), or the Atal Pension Yojana (if you are in the unorganised sector). The NPS is operated on behalf of the Government by half a dozen life insurance companies/banks – all chosen through a careful filtration process and with a good track record of combining safety and returns. The details are available on the NPS website (enps.nsdl.com).

Tax Breaks

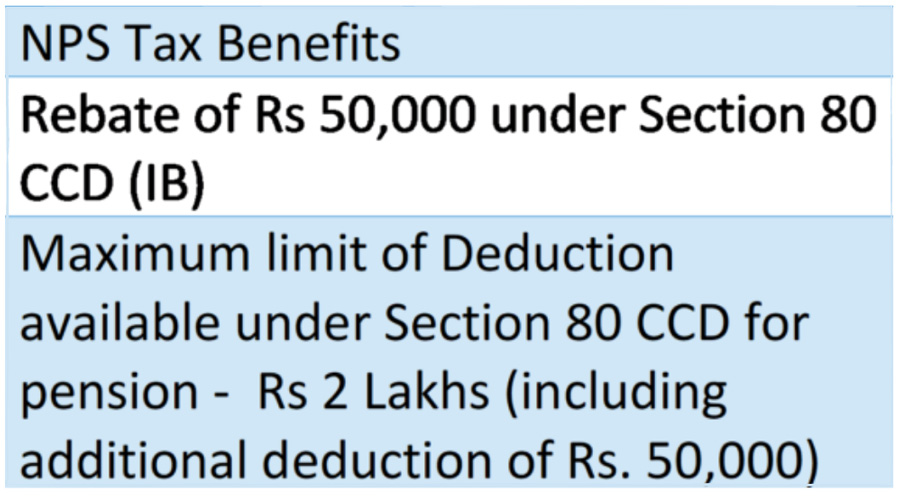

There’s no limit to the amount you can invest every year. But there’s an incentive in the form of a tax break. There’s a rebate of Rs 50,000 under Section 80 CCD (IB) for investments in the NPS scheme.

However, if you have not fully utilised the available rebates under Section 80C (for provident fund contributions, repayments on housing loan, life insurance premiums etc.), you can use that too for NPS contribution rebates. So, if you have no other deductions, you can technically claim Rs 1.5 lakhs for contributions to NPS under Sec 80 CCC (but note that all contributions under various sections 80C, 80 CCC etc. limited to Rs 1.5 lakh) and another Rs 50,000 separately under Sec 80 CCD (IB).

Consult your financial advisor or chartered accountant on how to structure your deductions and avail the maximum available deductions.

About pensions in India

For the longest time, pensions in India were simply associated with government jobs. Traditionally, government jobs yielded low salaries and private sector jobs at comparative levels offered salaries that were several shades better, with the number of perks thrown in.

In due course, the private sector caught on and began to offer provident funds as a sop. But the lump sum payment at the start of retirement was often seen as inadequate and couldn’t match the comfort offered by a steady annuity. Soon they too began to offer pension plans – which variedly widely in the returns they offered. It was time for the government to intervene and revamp the pension sector in India, as part of a wider financial sector reform. There was another pressing reason, which provided it further impetus – the government’s own poor finances.

Growing development ambitions had led to proliferation of government activities and this increased both employment in government and public sector – with a strong impact on wages and pensions. Revenue growth was however slower than the pace of expenditures and this weakened the financial position.

Now, it didn’t matter so much when average life expectancy was low. It might surprise readers to know that average life expectancy was a mere 40 years in 1960, and even as low as 57 in 1990. This was when the retirement age was 58 (raised later to 60).

The low life expectancy kept a kind of natural cap on the government liability on pensions. That’s changed over the years and today’s average life expectancy is 70 years.

With the government’s liability going up it was compelled to introduce the National Pension Scheme (NPS) and shift to what was called ‘a defined contribution’ system from a defined benefit system in 2004.

NPS was initially notified for central government employees as of January, 1, 2004 and subsequently adopted by almost all State Governments for its employees. NPS was later extended to all citizens of India (resident/non-resident/overseas) voluntarily and to corporates for its employees. NPS is compulsory for government employees who joined service after 2004 and it was opened to the private sector in 2009. According to data released by the pension fund regulator (PFRDA), the total subscriber base at the end of January 2021 crossed 4 crore, showing a y-o-y increase of 22%, over 3.3 subscribers a year ago.

The combined assets under management (AUM) of the National Pension System (NPS) and Atal Pension Yojana stood at ₹5.56 trillion as on 31 January 2021, posting a year-on-year growth of 37%.

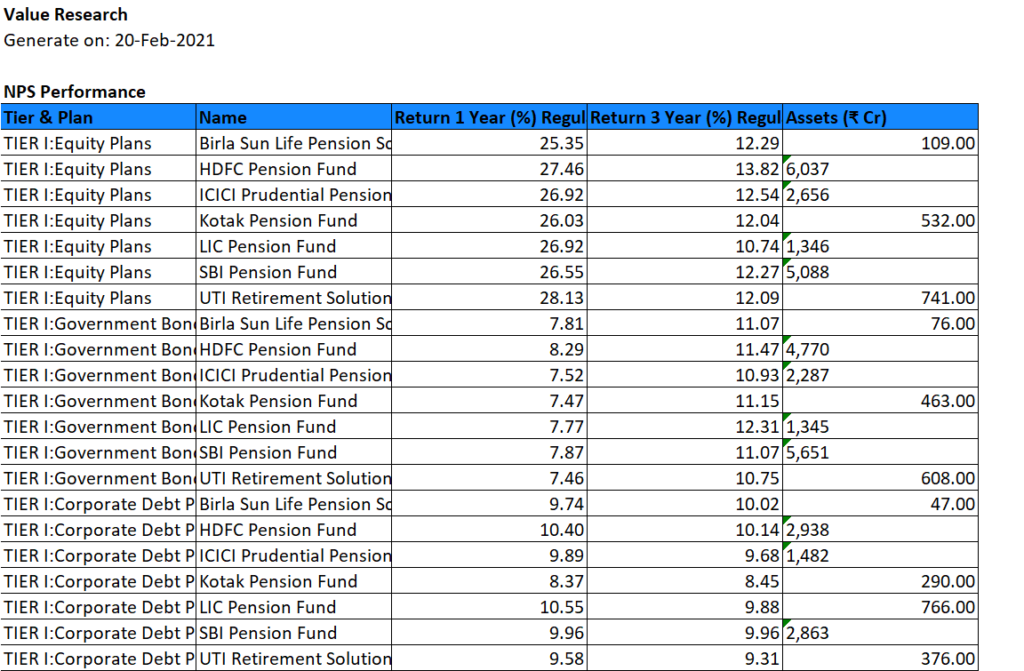

Incidentally, while the return on your NPS is not guaranteed as it is market-linked, as one can see below it has outperformed categories such as public provident fund (PPF). As listed below, the 1 year return on tier 1 : equity plan, has crossed 20% across different fund houses

So, invest in an appropriate pension plan to utilise tax benefits, create a substantial corpus and reap the benefits of a regular self-sponsored retirement income in your twilight years.

How does NPS work?

- Subscriber is required to open an account with any one of the POPs (Point of Presence) or through eNPS (https://enps.nsdl.com/eNPS/).

- Subscribers can operate their account from anywhere, even if they change the city and/or employment.

- NPS offers you two approaches to invest in your account:

a) Active choice- Subscriber selects the allocation percentage in assets classes

b) Auto choice- funds are automatically allocated amongst asset classes in a pre-defined matrix, based on the age of the subscriber.

(N S Vageesh is a Mumbai-based freelance journalist, who writes on banking and insurance.)

Pingback: 5 Points to Keep in Mind While Buying Life Insurance | MoneyMonc