Do sanitizers, double masks and steam inhales make you 100 percent safe from COVID-19? The second wave of Coronavirus sweeping the country has resulted in loss of lakhs of lives due to shortage of oxygen and hospital beds.

Most of us seeking treatment right now don’t have an adequate health insurance cover, leading families into financial and mental turmoil.

While IRDAI and insurance companies have come out with COVID-specific covers that offer financial protection against the virus, a recent report pointed out that India accounted for the highest out-of-pocket spending on health at 62 percent during the pandemic.

As per T A Ramalingam, CTO, Bajaj Allianz General Insurance, “The primary challenge these days is not having any insurance and the secondary challenge is having an inadequate cover, leading to huge out-of-pocket expenses on treatment. Lack of awareness, ignorance regarding financial risks and relying only on corporate cover (GMC) are the main reasons for this under insurance.”

Which one is better – COVID-specific policy or a comprehensive health insurance cover?

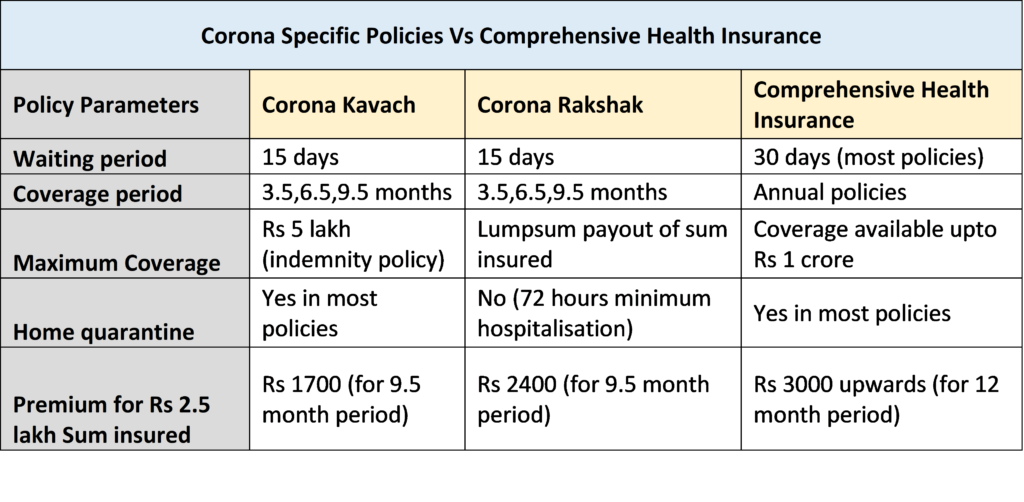

Currently there are two COVID specific policies in India – Corona Rakshak and Corona Kavach. These plans provide a short waiting period of 15 days, whereas an indemnity-based health insurance plan may have a waiting period of 30 days.

Corona Rakshak is a fixed benefit health insurance plan where a certain specific amount of money is paid out if you need more than 72 hours of hospitalisation for Covid.

Corona Kavach Plan has no sub-limits or deductibles or co-pay but there is a maximum limit of Rs 5 lakh of coverage that you can opt for.

It also pays for consumables that are usually not payable otherwise such as PPE kit, sanitizers, inhalers, oxygen masks, etc. The premium is low for these plans as well as compared to a regular indemnity plan.

As per Dr S Prakash, MD – Star Health, “Home quarantine for Covid-19 is covered under Corona Kavach. To avail the claim, the customer has to submit his/her Covid-19 positive report, consultation letters, home quarantine treatment plan, copy of daily medical records for temperature and SPO2, investigation reports, medicine bills etc.”

Apart from these two policies, there are a slew of health insurance products provided by various insurers which offer protection not only against Covid but any other ailments or accidents one may encounter. Many a times, customers are confused whether to opt for a COVID disease specific health insurance or choose an overall health insurance protection for themselves.

“A Corona specific plan should be taken only if you do not have any coverage and are looking for short-term concerns of the second wave,” says Dhirendra Mahyavanshi, Co-Founder of Turtlemint.

“It is surely not a permanent health insurance solution for you and your family,” he adds.

The price parameter

As per Mahyavanshi, Corona-specific health plans have low premiums as compared to regular health plans as their scope of coverage is also very limited.

“A regular indemnity health insurance plan provides a wide scope of coverage with very high sum insured levels. As such, their premiums are on the higher side,” he points out.

For example, for a Rs 2.5 lakh coverage for 9.5 months, the premium for a 40-year-old would be around Rs 1700 for Corona Kavach and Rs 2400 for Corona Rakshak.

“A regular health plan, however, is for a minimum of one year and the premium can be anything upwards of Rs3000. However, the coverage and the benefits would be proportionately determined to justify the same and it surely cannot be compared with a disease-specific health insurance plan.”

Even though the regular policies are priced higher, they offer several additional benefits such as:

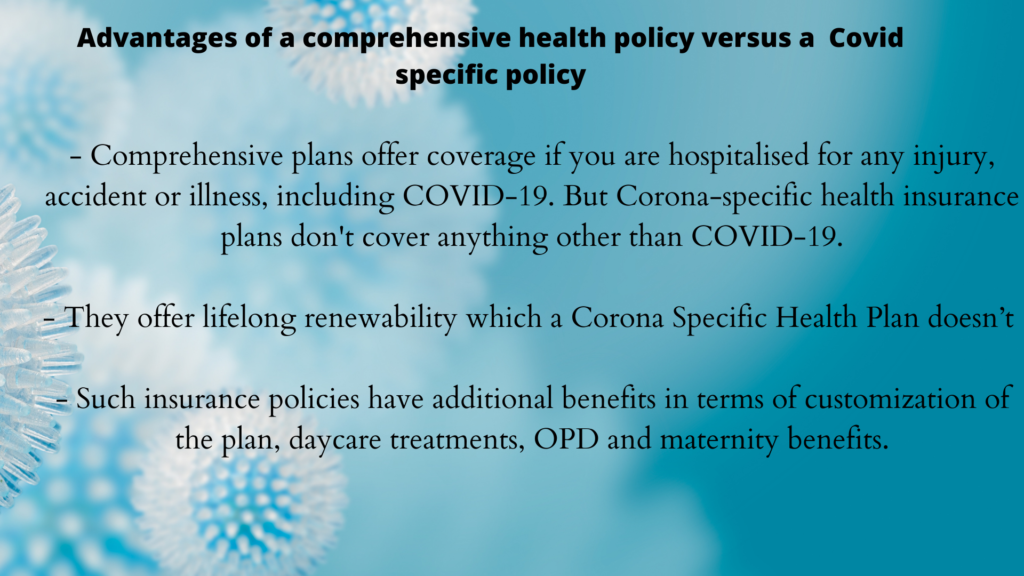

- Hospitalisation coverage for COVID related expenses as well as other diseases/accidental injury treatments. This means, if you are hospitalised for any other illness or injury or an accident, the indemnity-based health plan would cover the hospital bills. This is not covered by a Corona-specific health insurance plan.

- They offer lifelong renewability which a Corona Specific Health Plan doesn’t provide.

- Such insurance policies have additional benefits in terms of customization of the plan, day-care treatments, OPD and maternity benefits in certain plans, etc.

For those above 65 years

Corona-specific plans do not provide coverage to individuals aged over 65 years. However, there are other regular health insurance plans and senior citizen plans which do.

“People above 65 years can be covered under health indemnity plans,” says Ramalingam.

“Some of our plans extend cover up to 100 years or beyond without any upper cap on the entry age. However, medical screening is required for opting for a health policy at this age.”

Though the COVID phase has raised public awareness on the health insurance front, sum insured and coverage adequacy remain major concerns.

“The industry as such is not seeing big numbers of COVID-specific policy sales off late. By now people have understood that they should go for a complete protection health insurance plan which can really help them in the long run,” says S Prakash.

While having a comprehensive coverage is the need of the hour, we sum up our inference with what Dr Sudha Reddy, Head – Health and Travel, Digit Insurance says: “You should definitely have a comprehensive health insurance policy so that you are covered against any medical emergency. You should then evaluate its Sum Insured adequacy, considering that if all members need hospitalization, will your policy sum insured suffice for or not. If not, then take a top-up cover to increase your sum insured or opt for a Corona-specific cover additionally.”

(Elizabeth Mathai is a Kochi-based content creator and a therapist, with expertise in insurance)