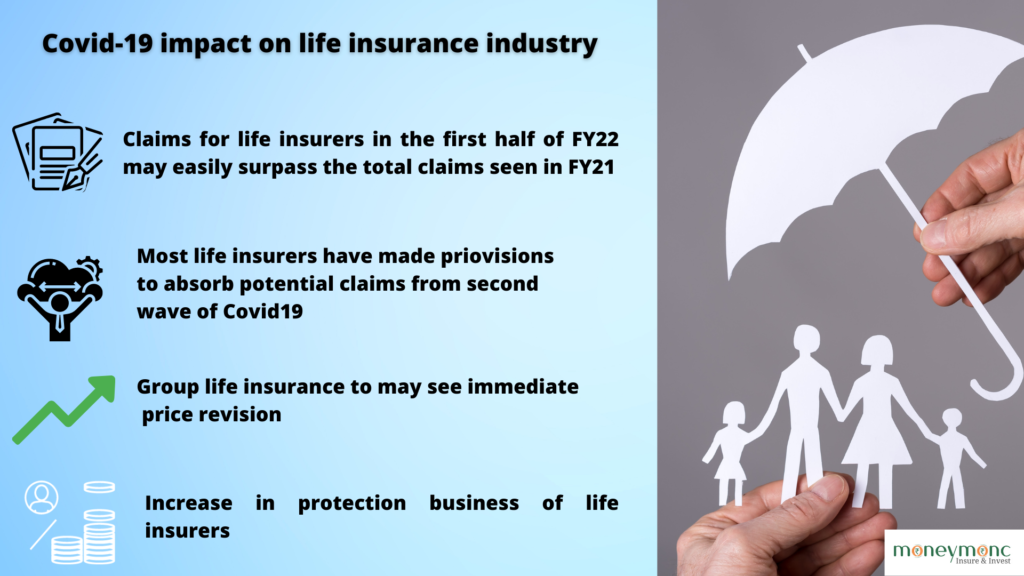

Claims for life insurers in the first half of the current fiscal year may easily surpass the total claims seen in FY21 amid the surge in second wave of Covid-19 infections and fatality rates.

“Most insurers reported a higher claim experience in FY21 and have made provisions to absorb potential claims that may arise in the wake of a more devastating COVID 2.0. We note that against the total COVID-related deaths of around 1.63 lakh reported in FY21, the fatality count has already increased to about 1.52 lakh in FY22 so far. The claim experience is thus likely to stay adverse over the next couple of quarters, all the more due to delays in the reporting of claims,” Motilal Oswal Financial Services said in a report.

Life insurers (in aggregate) have settled claims worth Rs 1986 crore towards 25,500 COVID-related death claims. This corresponds to 15.7 percent of the total COVID-related fatalities in FY21. Among the key companies, HDFC LIFE settled 2,30,000 death claims, IPRU 2,50,000 and SBILIFE 5,000 death claims, in FY21.

Net of reinsurance, these companies have thus incurred cost of Rs 150 crore, Rs 260 crore and 320 crore, respectively.

“While HDFC Life and SBI Life made Rs 165 crore and Rs 183 crore worth of provisions, IPRU has provided for Rs 330 crore worth of provisions. Given the sharp rise in fatality rates, the insurers would need to shore up their provisioning buffers, which would impact their profitability/EV,” it adds.

However, the report says it does not pose any material risk to the overall balance sheet or solvency ratios.

Rise in protection business for life insurers

Rising awareness about term life insurance aided by the fear psychosis induced by the COVID-19 pandemic, has resulted in a sharp rise in the total annual premium equivalent (APE) across the life insurance industry. Among the listed insurers, HDFCLIFE has a higher share of the Protection business coming from Credit Life, while IPRU and MAXLIFE have a higher focus on the Retail Protection business. SBILIFE has a higher proportion of ROP business in Individual Protection in the range of 84 to 85 percent.

In an earlier story, Moneymonc had reported that insurers have turned cautious about selling term life insurance policies, particularly as reinsurers have either increased charges or have temporarily withdrawn from the segment. New customers now have to cooling period of three months after being Covid positive, fill in detailed covid questionnaires, medical reports, and undergo tests to purchase term life insurance policies with insurers tightening their underwriting provisions.

Group life insurance to may see price revision

According to the Motilal Oswal report, Group Term products, which are annually renewable, are likely to see price revisions on higher demand for such products in recent times.

“Most insurers took price hikes in early FY21 after an adverse claim experience resulted in reinsurer hiking rates. Given that individual term products are of longer tenure (20–30 years), the adverse claim experience due to an event does not necessitate an immediate price change,” said the report.

Additionally, the report said that long-term savings products offered by life insurers are relatively more risk-tolerant as the lower sum assured and longer product duration enables insurers to absorb volatility.