The Coronavirus pandemic has resulted in a significant shift towards tele-consultation and telemedicine in the healthcare industry. Telemedicine essentially allows registered medical practitioners to use online video consultation as most people avoid visiting the hospital due to the fear of contracting the virus.

Telemedicine has been a boon for millions as they are able to access the doctors from the safety and convenience of home. However, this has created a paradigm shift in the health insurance space where traditionally the standard cover was geared mainly towards covering expenses resulting from a minimum 24-hour hospitalisation. A standard health insurance plan is an indemnity product, implying that it pays only for in-patient treatment in case of an illness or disease.

But today, insurers are extending covers for digital consultation and home care as well. At the peak of the pandemic, with the shortage of hospital beds, lakhs of people turned towards homecare treatment through tele-consultation.

When it came to primary care, patients were comfortable with home care treatments and medicines being delivered at their doorstep.

“COVID has been a tailwind for the telemedicine industry. Like demonetisation was to digital payments, COVID-19 is making adoption of online health exponentially faster,” says Satish Kannan, Co-founder & CEO MediBuddy.

“With e-health becoming the new normal, we have seen a 64 percent increase in online consultations in 2020. About half of these are from non-urban areas,” he adds.

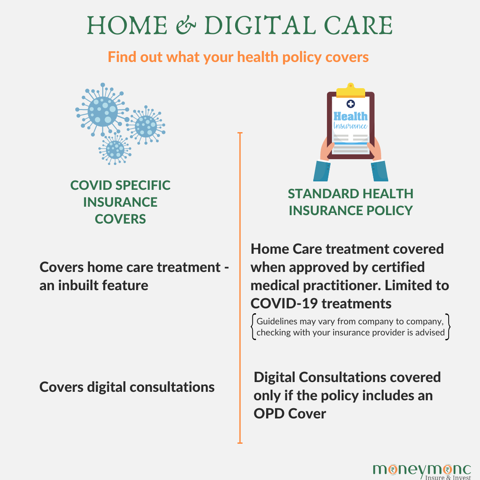

While cover for home care and virtual treatments is inbuilt under the Corona Kavach policy (Corona-specific plan) launched last year, some insurers are extending cover for home care treatments to both their standard health and group health customers as well when advised by a certified medical practitioner.

Currently, this is being extended to only COVID-19 specific claims. When it comes to costs for digital/tele-health consultations, they are covered when you have an existing policy that covers OPD related expenses or if it is an expense related to pre and post hospitalization.

“Digital health consultations and home care treatments are covered depending on the policy offering. An insurance policy with an inbuilt cover for OPD treatments will cover digital health consultation,” says, Sanjay Datta, Chief Underwriting, Claims and Reinsurance, ICICI Lombard General Insurance.

“COVID-specific insurance products cover home care treatments; however, we are extending the cover for home care to our standard health policy customers when advised by a certified medical practitioner,” Dutta adds.

So say an individual with a standard health insurance policy is diagnosed with COVID-19 and is advised by his treating doctor to undergo a series of scans and blood tests to rule out any serious infection in the lungs and is subsequently advised home care. In this case the cost incurred for the tests, medicines and the online consultation fees will be payable by the insurance company.

Similarly, if the individual is suffering from mild symptoms and is advised just rest and some medicines to recover, then the costs incurred will only be covered if the individual has an OPD specific cover in his standard health policy.

Certain insurance companies are covering this cost irrespective of the OPD cover, given the unprecedented situation. You may want to check this with your insurance provider before filing the claim. However, in case of a Corona Kavach Policy, the cost will be covered in both the given scenarios.

While the pandemic exhibited the ability of insurers to have a completely paperless claim settlement process, insurers also started looking at their service deliveries differently thanks to tech interfaces.

“Due to the pandemic we introduced Virtual Relationship Manager to help take care of the claim process and queries. While initially, most of the Covid-19 patients were hospitalised, gradually we saw that hospitals started providing services to Covid-19 patients from the comfort of their homes, which has seen a good offtake and we have been covering the cost for home care treatments for our customers”, says Bhaskar Nerurkar, Head – Health Claims, Bajaj Allianz General Insurance.

A survey with some of the key insurance and health care players revealed that the trend of virtual care and tele-medicine is here to stay and may soon become a permanent feature. It also revealed that in the future home care will be a preferred option for primary treatments.

While insurance cover for home care treatment is currently restricted to Covid-19, going forward it can be extended to other illnesses that can be treated at home.

“Home care treatment is a win-win situation for both the policyholders as well as insurers. Hospitalisation includes ancillary costs such as food, services taxes etc. and it amounts to 10 to 30 percent of the total cost, which can be saved,” says Dr Sudha Reddy, Head, Health and Travel at Digit Insurance.

Digital-consultations may have limitations while examining patients but it is definitely becoming a preferred option for simpler and non-emergency cases. “Tele-medicine, virtual consultation, digital delivery, domiciliary treatments, prevention and wellness and focus on a healthier lifestyle are some clear trends. We can expect a further build-up of health ecosystems which will provide a comprehensive offering to consumers,” says Roopam Asthana, CEO & Whole Time Director, Liberty General Insurance.

(Chandni Arora is a Jodhpur-based writer, who writes on Insurance, culture and lifestyle.)