What is Atal Pension Yojana?

It is a minimum pension guarantee scheme by the Central government, where one can opt for a minimum monthly pension of Rs1000, Rs2000, Rs3000, Rs4000 or Rs5000. The pension scheme starts paying after the age of 60 years. The objective of this scheme is to ensure a sense of financial security so that people do not have to depend on anyone to meet their basic necessities post-retirement.

Who is it for?

The government has intended it ideally for workers from the unorganised sector like maids, watchmen, drivers, construction workers etc. but then any Indian citizen between the ages of 18 and 40 years, residing in India can be a beneficiary under the scheme.

How can you apply?

- Download the form online from the Pension Fund Regulatory and Development Authority (PFRDA) Official Website and fill it up at your local bank branch. Alternatively, the Atal Pension Yojana subscription form is available on the website of almost all major banks (private as well as public sector) operating in India. The forms are available in English, Hindi, Bangla, Gujarati, Kannada, Marathi, Odia, Tamil, and Telugu.

- Since the process has not been made online yet, you will have to visit the local bank branch to complete the formalities. Do carry copies of your Aadhar Card.

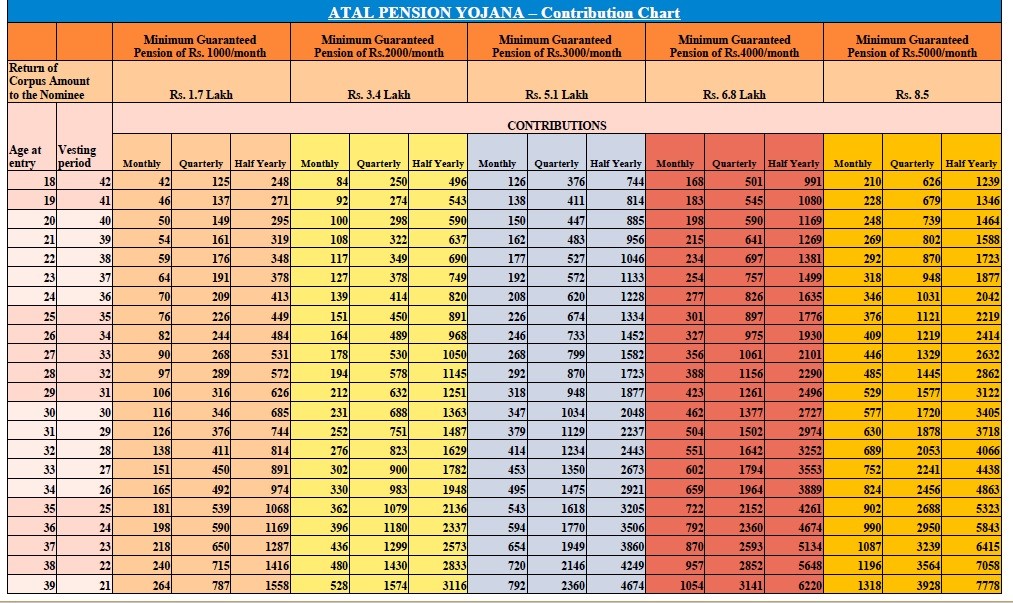

- On the form, enter your account number, Aadhar Card details, and mobile number along with choosing the pension scheme you wish to opt for. The scheme details are below:

Source NSDL

- Basis your age, the scheme you choose, and whether you opt for monthly, quarterly or half-yearly deductions, your subscription amount gets generated as per the chart above.

- This amount will be deducted from your linked bank account at the time of account opening.

- Your bank will issue acknowledgment No/PRAN No. to you.

- Subsequent contributions will be automatically deducted from your bank account through the auto-debit system.

What are the benefits of the scheme?

- Unlike other schemes which are subjected to market risks, the Atal Pension Yojana guarantees the returns as per the plan chosen by the subscriber ranging from Rs1000 to Rs5000.

- Tax exemption benefits up to the Rs 1.5 lakh cumulative annual limit under Section 80C of the Income Tax Act, 1961. It also qualifies for additional benefit of up to Rs 50,000 annually under Section 80CCD (1) of the Income Tax Act, 1961.

- Contributions can be upgraded or downgraded based on subscriber’s choice, once in a year

- Flexibility to choose contributions on a monthly/quarterly/half-yearly basis

- Guaranteed benefits for spouse/nominee/next of kin as per applicable rules in case of demise of the APY subscriber.

What if you want to discontinue Atal Pension Yojana scheme?

- If you default your payments, a penalty would be levied basis the plan opted by you.

- If the payment is defaulted for 6 months, your account gets frozen, and if the default is continued over the next 12 months, the account is closed and the remaining amount is credited to the subscriber’s bank account.

- Voluntary exit from the Atal Pension Yojana is permitted only in cases like death or terminal illness, where the subscriber or his /her nominee may receive the entire amount back. This can be done by submitting the exit form at the bank where the account was opened.

- Post calculating the total contribution plus interest accrued on the account and deducting any APY account closure/maintenance charges, the bank credits the balance amount as a lumpsum into the registered bank account.

(Elizabeth Mathai is a Kochi-based content creator and a therapist, with expertise in insurance)