The net profit of top three listed life insurance companies was pulled down by rising Covid claims during the April-June quarter even though the business is expected to be back on track soon given the rising number of people opting for life insurance.

“India’s private life insurers’ business growth has taken a blow once

more this year due to the second wave of the pandemic and the subsequent local level lockdowns across major parts of India; however, business is expected to pick-up again from the second quarter as governments across various states lift restrictions in a phased manner,” said Deepak Parekh, chairman, HDFC Life.

HDFC Life, ICICI Prudential and SBI Life have witnessed the stress of huge claim payout in the first quarter of the current fiscal, ending March 31.

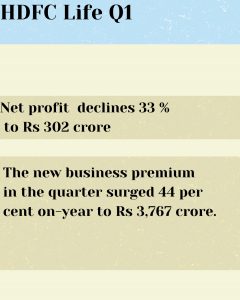

HDFC Life reported Profit after Tax of Rs 302 crore (33 per cent lower than Q1 FY21), on the back of higher claims.

“The strength of our balance sheet and back book surplus has enabled us to absorb the shock of heightened claims, while continuing to deliver growth,” Vibha Padalkar, MD & CEO of HDFC Life, said.

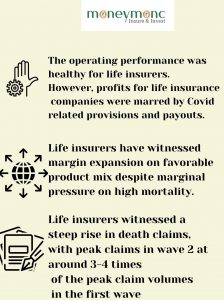

“We witnessed a steep rise in death claims, with peak claims in the second wave at around 3-4 times of the peak claim volumes in the first wave. We paid over 70,000 claims in Q1. The gross and net claims provided for amounted to Rs 1,598 crore and Rs 956 crore respectively,” she said.

“Based on our current claims experience, we have set up an additional reserve of Rs 700 crore to service the claims intimations expected to be received. Our endeavour is to promptly settle every bona fide claim,” she added.

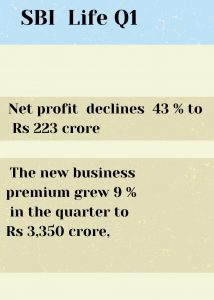

SBI Life Insurance too reported 43 percent sequential decline to Rs 223.2 crore in the quarter ended June.

“Keeping in mind the impact of second wave on claims pay-outs, we’ve done prudent provisioning for Covid-19 related claims, which led to a momentary dip in profits, though the intrinsic fundamental growth drivers for the insurance sector continue to be optimistic,” Mahesh Kumar Sharma, MD & CEO, SBI Life, said.

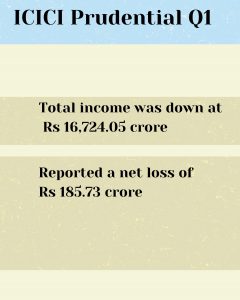

ICICI Prudential Life too reported a net loss of Rs 185.73 crore for June quarter 2021-22 against a net profit of Rs 287.59 crore in the year-ago period.

Death claims have been significant in case of ICICI Pru too during the

second wave partly due to exposure of the younger (under 45 years) and the affluent segments, which have been more severely impacted. Around 60 per cent of the increase in average claims for the company can be attributed to change in customer profile that is making claims.

Protection and individual new business premium grow

Alongside, the pandemic has heightened consumer awareness regarding life insurance, with many, including millennials, now realizing that insurance is a necessary safeguard against life’s uncertainties.

Not surprisingly, SBI Life registered a healthy 46 percent growth in protection and 37 percent growth in the Individual New Business Premium in Q1 FY22 over the corresponding quarter last year.

The growth was driven by health insurance and life insurance premiums. Unlike their peers in the non-life insurance sector, life insurers offer benefit health insurance policies and settle the claims by lump sum payouts.

“The growth in the industry was driven largely by health and life

insurance premiums,” said Shrikant Chouhan, EVP (equity technical research), Kotak Securities.

“The operating performance was healthy for life insurers. However, profits were marred by Covid-related provisions and payouts. However, we reckon these are one-offs,” he added.

“The operating performance has been on track and we expect it to continue. Life insurers have witnessed margin expansion on favorable product mix despite marginal pressure on high mortality,” he added.

ULIPs witnessed traction and ICICI Prudential Life and SBI Life saw the shares rise. Persistency improved across most buckets.

HDFC Life’s Vibha said against the backdrop of disruption in business in Q1, the company recorded 22 per cent growth and market share of 17.8 per cent in the private sector in terms of Individual WRP.

“We clocked 40 per cent growth in terms of value of new business and we achieved a New Business Margin of 26.2 per cent in Q1. Our product mix continues to remain balanced and our annuity business witnessed strong growth of 61 per cent in this quarter. In comparison to Q1 of last fiscal, the company clocked higher renewal collections, with 13th month persistency improving from 87 per cent to 90 per cent,” she added.

SBI Life saw a surge in demand for protection plans (13 per cent of mix), mainly aided by demand for group protection.

For ICICI Pru, total claims on account of Covid in Q1 for the company were Rs 11.2 billion. Claims net of reinsurance were Rs 5 billion. The company has provisions of Rs 4.98 billion (Mar-21: Rs 3.32 billion) held for future Covid claims including IBNR (incurred but not reported). Net Covid claims during the period were 2.52x FY21, says a study by Nirmal Bang Institutional Securities.

It has made Rs 3.84 billion reserves for non-Covid claims (actuarial liability).

NS Kannan, MD & CEO, ICICI Prudential Life Insurance said, “Despite the challenges posed by the second wave of the pandemic, we

have been able to demonstrate both resilience and growth in this

quarter.”

The company’s new business premium grew by 71 per cent year-on-year to Rs 25.59 billion in Q1-FY2022. “Further, we are delighted to have achieved the distinction of becoming the overall market leader in terms of new business sum assured, which grew 89 per cent year-on-year to Rs 1.77 trillion,” he added.

“Our value of new business grew by 78 per cent year-on-year to

Rs 3.58 billion in Q1, reflecting the growing profitability of our business. The VNB margin too increased from 24.4 per cent for Q1 to 29.4 per cent for the period. With this strong growth momentum along with our well-diversified product and distribution mix, we believe we are well positioned to achieve our stated objective of doubling our FY2019 VNB by FY2023,” he added.

(Kumud Das is a Pune-based teacher and freelance journalist, who writes on insurance, banking and human interest stories)