In a country where 60 percent of the loans are sanctioned in just Delhi-national capital region (NCR) and Maharashtra, it is obviously difficult for those in tier 2 and tier 3 cities to buy their dream home. The tedious home loan process and lack of bank branches in small towns has made it difficult for millions of potential buyers to purchase a house.

It is to tap this segment that Atul Monga, Kalyan Josyula and Pranav Khattar set up affordable home loan company BASIC Home Loan in 2020.

The Gurugram-based start-up offers a phygital model (a mix of physical and digital presence) to help middle and low-income households, especially in small towns, get the right home loan.

Also Read: How investing in a pension plan helps you save tax and plan for retirement

As per data from the Reserve Bank of India, while 60 percent of the loans are sanctioned in Delhi-NCR and Maharashtra, the remaining 40 percent covers the rest of India, including Bangalore, Hyderabad, and Chennai.

“Banks are not able to service Tier 2 and Tier 3 cities as effectively as Tier 1 cities. So we decided to focus on this segment, where the potential is huge but remains untapped,” says Monga, co-founder and CEO of the company.

Last October, BASIC Home Loan raised a $500,000 seed round from Picus Capital, a Germany-based early-stage technology investment firm.

Demand-supply gap in home loans

Monga says during his stint in the mortgage industry, he discovered issues on both the supply side and the demand side.

Most major banks in India focus on big-ticket loans and purchase loans from smaller housing finance companies at the end of the year to meet priority sector lending targets.

“But most of these smaller HFCs don’t have a tech model, and often charge customers an upfront processing fee, which is a cost to the customer if the loan is rejected,” Monga explains.

Also Read: How good is your health insurance company in settling claims and addressing grievances?

On the demand side, customers seeking a home loan have two options. They can either visit a bank on their own or go to an online loan aggregator. “In the first case, they find difficulty in comparing the loan offers from different banks, while in the case of online aggregators, there is no handholding of the customer. This is where he believes BASIC Home Loan fits in,” he says.

The company’s phygital model works with agents across the country, who can be chartered accountants, financial advisors, real estate brokers, etc. And it has an app, which helps the agents guide borrowers to the right home loan.

“Home loans are a difficult product with a lot of customisations. You have to evaluate yourself as well as the property, then get legal and technical approvals, undertake property registration. Our tech platform eases a lot of these procedures,” Monga says. The company has done business in 60 districts in 15 cities and have served about 2000 customers in getting home loans. In FY22 we aim to have presence in 150 to 200 districts in around 30 cities and to serve 10000 customers.

The company also handholds customers through the loan process, including co-ordinating with the bank and handling offline elements. The service is completely free.

“We help the customer in getting better interest rates or improving loan-to-value (the percentage of a property’s purchase price that the home loan covers) through home insurance,” he says.

Also Read: Shriram Life to post highest-ever profit this fiscal: Manoj Jain, MD

Moreover, the company helps customers avail of government schemes like the PMAY interest subsidy. Under the Prime Minister Awas Yojana (PMAY), households with an annual income of up to Rs18 lakh are given Rs2.3 lakh upfront subsidy for a home. Buyers are also eligible for income tax exemption on housing loans. But most customers remain unaware of the schemes. BASIC Home Loan helps them make the most of these measures.

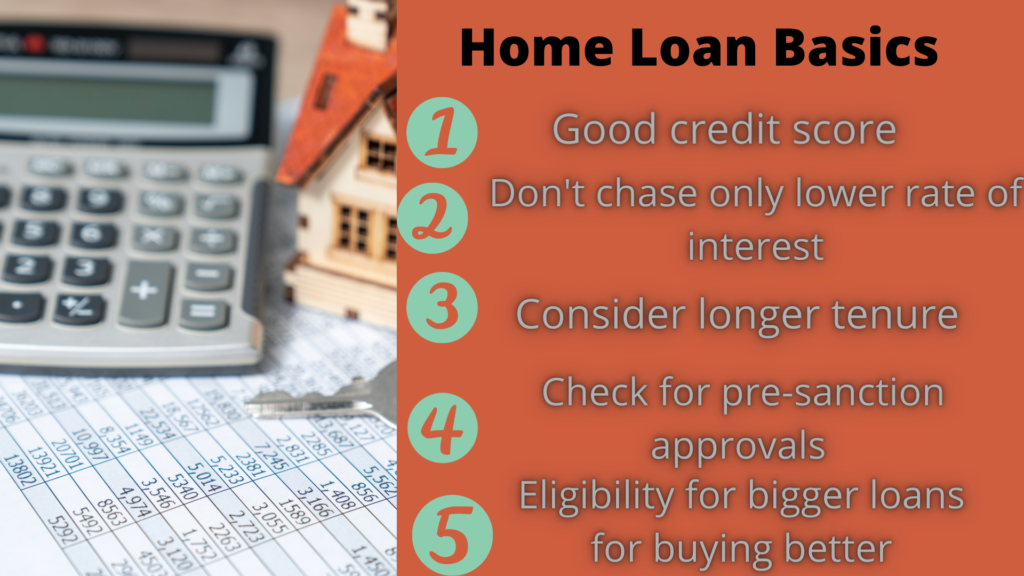

The home loan checklist

Monga said most customers assume that a good credit score only helps to secure a personal loan. However, it is helpful for home loans too. So it’s prudent to maintain a good score.

Second, don’t simply chase a lower rate of interest. For example, someone who is young could consider a longer tenure instead.

Three, always ensure correct and complete documentation. Otherwise, the application will get delayed.

Lastly, be aware of pre-sanctions approvals. Many times, a customer will realise only at the time of loan sanction, that he/she was eligible for a bigger loan, which could have helped them buy a better property.

“Getting a pre-sanction gives the customer a clear budget before they begin looking at properties,” Monga explains.

The company has an asset light model where instead of creating physical infrastructure in every town, it is partnering with brokers and agents to keep costs under check. “We are in discussion with a few venture capital funds for raising funds, but nothing concrete as yet. As for diversification, we want to foray into lending but will remain focussed on the home loan space,” he says.

(Mandar M Bakre is a Pune-based freelance journalist with over 15 years of experience in journalism & communication, primarily in the business domain)

Also Read: Why you should move your insurance documents to DigiLocker